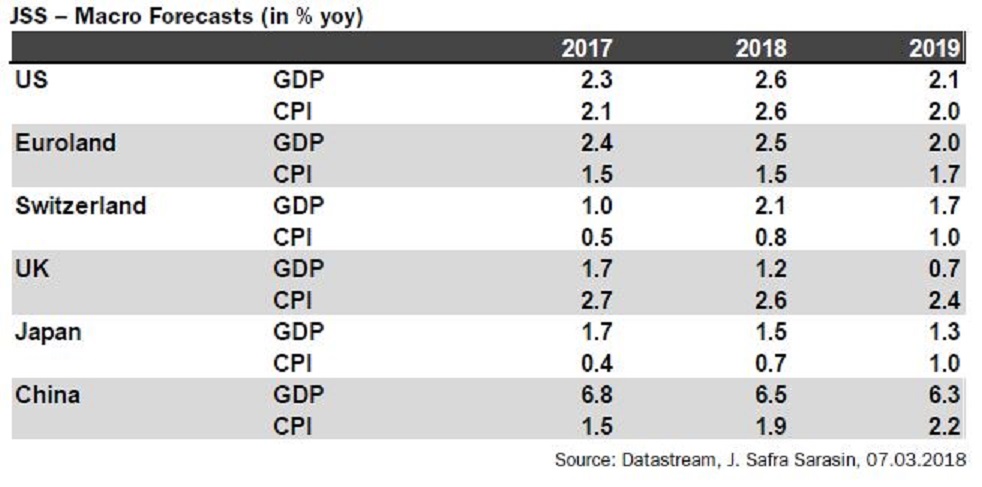

Growth remains very strong in all regions and recession risks are low even though the US-fiscal policy increases the medium-term risks of a boom-bust cycle. Main forecast revisions are that we now expect four Fed hikes in 2018, one Bank of England rate hike in May and even stronger growth rates in the eurozone and Switzerland this year. Market focus will shift to inflation developments where we are likely to have seen the trough for this year in February.

In the US, growth maintains momentum, as shown by the latest surveys of activity. Hard data suffered a partial setback at the beginning of the year, as revealed by some softness in new orders for durable goods and factory orders. Some more headwinds may temporarily result from a slowdown in personal consumption and a widening of the trade deficit.

Nonetheless, the macroeconomic fundamentals remain robust, and thanks to the further tailwinds offered by the tax cuts and the spending bill approved by the Congress, we expect solid growth in the coming quarters. On the flip side, growth momentum in conjunction with a weaker dollar and higher energy prices has the potential to fuel inflation, especially in the near term, where the base effect might lift inflation readings closer to 3 percent by the early summer.

The shifting distribution of risks surrounding inflation has been noted by the Federal Reserve; we do not envision a dramatic turn towards a more hawkish stance, but overall economic conditions clear the path for a marginally less gradual removal of monetary accommodation.

"We have increased our growth forecasts for the euro area to 2.5 percent in 2018 and 2.0 percent in 2019 and the Swiss forecast to 2.1 percent this year. Labour markets improve in both currency areas and lay the ground for higher consumer confidence, stronger private consumption, and higher wage increases. As an example, the unemployment rate fell to 2.9 percent in Switzerland – a level lower than end 2014 before the discontinuation of the currency-floor", the report added.

Finally, the ECB decided to get rid of its easing bias in its policy statement. Given the scarcity of government bonds, strong growth, tight credit spreads and somewhat increasing inflation rates this move can be easily justified. It was not necessarily expected by markets to take place at the meeting this month but implies that the ECB will be under less pressure to adjust its communication at the April meeting.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility