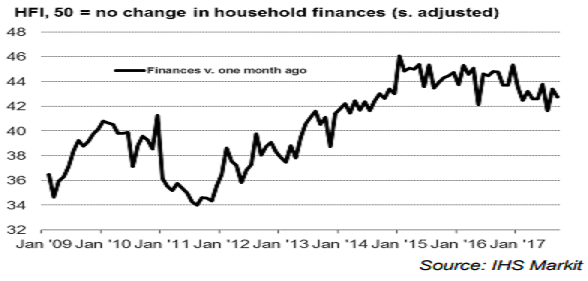

The United Kingdom’s households experienced sharp deterioration in household finances, with the average HFI reading in Q3 2017 being the weakest in three years. This is largely owing to rising living costs and subdued pay growth amid fall in the cash availability to spend.

The seasonally adjusted IHS Markit Household Finance Index (HFI) registered 42.8 in September, down from 43.4 in August and well below the neutral 50.0 threshold. The average index reading dropped to 42.6 in Q3, which was the lowest since the third quarter of 2014.

Intense pressures on household finances were recorded across all regions in September, driven principally by the on-going squeeze on real incomes from higher prices and low wage growth. The amount of cash available to spend continued to fall at one of the steepest rates seen over the past three years.

However, spending rose again, and at an increased rate, fuelled by a combination of modest growth in income from employment and reduced savings. Households meanwhile indicated a continued recovery in their house price expectations from the 10-month low seen in June.

At 53.8 in September, the seasonally adjusted index measuring workplace activity was comfortably above the 50.0 no-change value. The average reading for Q3 2017 (53.4) was little changed since the previous quarter (53.5), suggesting a further steady expansion of the economy.

Meanwhile, only a small minority of UK households expect a Bank of England rate rise by the end of 2017 (12 percent). Around 29 percent of survey respondents forecast a rate rise over the next six months, a figure which is broadly in line with the trend seen since the index began in mid-2013, IHS Markit reported.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk