The United Kingdom’s economic growth is expected to slow to 1.1 percent this year from 1.4 percent in 2018. Assuming that a Brexit deal with the EU passes parliament ahead of a transition period that preserves the status quo of single market and customs union membership, growth is expected to pick up to 1.5 percent in 2020, according to a recent research report from Schroders.

Further, inflation is expected to fall to 1.8 percent in 2019 thanks to an expected rise in sterling, but stronger growth is expected to push inflation up to 2.4 percent in 2020. Meanwhile, the BoE is expected to hike once in 2019 and twice in 2020 (to 1.5 percent).

Brexit continues to dominate everyday life in the UK. News, politics and even lowly economists pray for a break from the mundane gridlock and circular arguments. Now that the Brexit deadline has been extended to October 3, a little breathing room has been created to allow other topics to come into the fray, the report added.

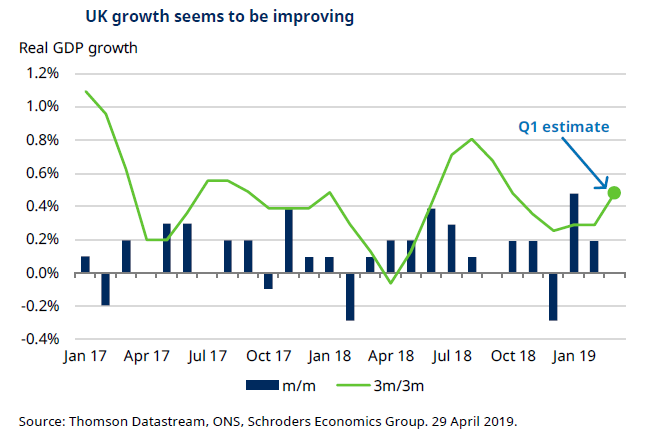

The medium to long-term outlook for the economy will be heavily influenced by Brexit, but in the near-term, data seems to have improved. The Bank of England had downgraded its growth forecast for the coming quarters citing a more negative impact from Brexit uncertainty than it had previously anticipated.

However, recent data has surprised to the upside. The monthly GDP release for January showed a significant improvement, as GDP growth picked up to 0.5 percent compared to -0.3 percent in December.

A cautious approach to analysing the momentum of the UK economy will be required in coming months. The improvement in monthly GDP figures appears to be driven by stockpiling, and not final demand. This may have been a reaction to Brexit uncertainty, but is still likely to lead to a slowdown in growth in the near future. Meanwhile, leading indicators of activity in the services sector suggest a slump could be on the horizon, Schroders further noted.

For the Bank of England, despite showing ambition to raise interest rates back to more "normal" levels, the Bank is unlikely to follow through given the poor quality of growth the UK is experiencing, set against a backdrop of ongoing Brexit uncertainty.

The government should also take note. Celebrating the forthcoming pick-up in GDP growth for the first quarter could prove to be premature. Indeed, Chancellor Philip Hammond has indicated that he may need to delay the next comprehensive spending review due to the delay in Brexit.

"Committing to a multi-year spending programme (which is likely to be stimulative) at a time of great uncertainty would be a big gamble. Still, at least the UK is well stocked with luxury hampers and preservatives," the report added in its comments.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength