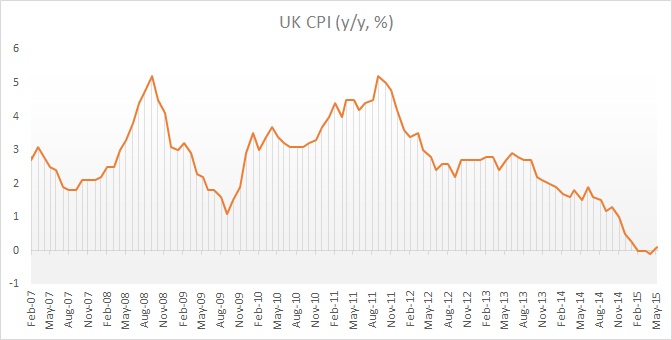

Lot of noises were made and headlines filled after UK moved into deflation as measured by annual change in CPI moved into deflationary zone in April for the first time since sixties.

Today's inflationary data indicated UK is out of deflation. CPI grew by 0.1% in May from a year ago. It is way too early to say that inflation stands ready to reverse. Last time Britain has deflation was in 1960, price dropped by -0.6%.

Data, despite jump back to inflationary territories continue to show that disinflationary pressure still remains at large in UK.

- Consumer price index is barely rising at 0.1% from a year ago.

- Producers' cost of input is still going down at considerable pace, which means overall cost pressure to remain subdued.

- Input costs are down by -12% in May from a year ago and down by -0.9% m/m. That is pushing the output prices down. Producer price index for output down by -1.6% from a year ago.

Though bank of England (BOE) has maintained rhetoric of not to cut rates as oil price is to be blamed according to them. However persistent disinflationary pressure means, even if BOE doesn't cut, it is far away from hike.

Pound is currently trading at 1.556, under pressure since the inflation release.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate