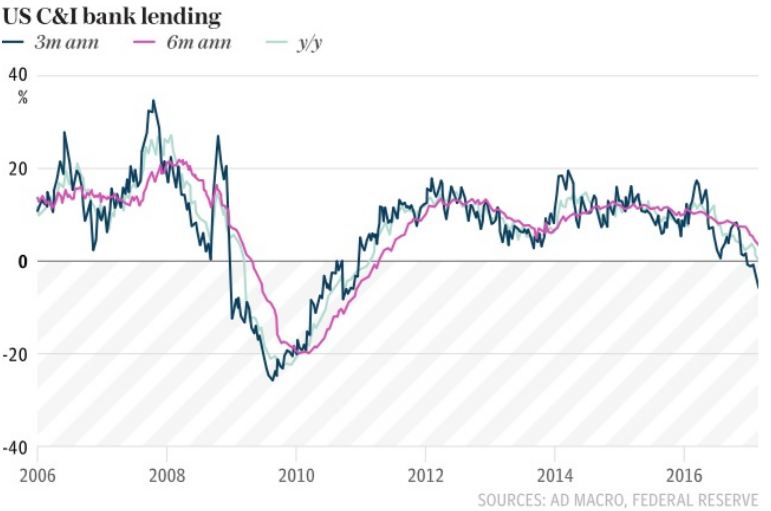

US bank lending has shifted surprisingly to the downside now that Trump Trade is losing momentum with markets. This has many analysts and credit strategists deeply concerned. With bank lending now heading south, this may dovetail with a contraction in overall economic activity in the world’s dominant economies – China and the US. At the start of the year, Wall Street was ebullient. The Dow Jones Industrial Average shattered records as it ascended the 20,000 level. The NASDAQ composite index and the S&P 500 index moved sharply higher as overall investor confidence in the US economy grew. The prospect of a Trump presidency in full flight is perceived as bullish for Wall Street. Deregulation, decreased taxation, increased protection for US industry, a replacement for current costly healthcare premiums were but a few of the many promises made by Team Trump.

Reality Sets in – Trump Trade Fades and Markets Fizzle

With the scathing defeats on immigration and healthcare, the Trump presidency is being hamstrung at every turn. This has dampened expectations in the first 100 days of his presidency, but not blighted them. Trump will get his nominee confirmed by the Senate, even if the nuclear option is imposed for the Supreme Court. Trump will get the Keystone Pipeline up and running, and Trump will take a more active role in combating ISIS, other terrorist groups and ensuring the safety and security of the United States. He faces an upward battle on tax reform, healthcare and deregulation, but he has momentum on his side.

There is concern however that US corporate borrowing is falling. This is a negative sign, and it is similar to the set of circumstances that precipitated the Lehman Brothers crisis. The growth of the US money supply is declining. This is a negative economic indicator and one that will have regulators, analysts, and the political elite concerned. The $2 trillion market for industrial loans and commercial loans hit its peak in December 2016. An abrupt tightening has taken place since then, especially with nonresidential properties. This is the slowest rate of growth since December 2008. There has also been a weakening in the $9 trillion market for leases and loans, falling 1.6% over the past 3 months. The Fed is raising interest rates when people are borrowing less – this is something that befuddles many analysts, yet it is happening at an increasing rate.

Can Main Street borrowers sustain the contraction in credit issuance?

While the big data indicates a contraction in the number of loans and credit facilities being made available by banks in the US, there is plenty of wiggle room for everyday borrowers. It’s important to get a grasp on credit report basics. In a tightening market with rising interest rates, the availability of credit becomes even more important. There are ways to keep the proverbial door open to the lowest possible APR, low interest rates, and affordable mortgage rates by understanding the importance of each element in a credit report. These credit reports are comprised of multiple components such as bills, debts, and other factors. The synergistic effect of these bills, debts, types of credit, and timely payments results in a credit score. Once these financial obligations have been met, credit unions will look at a host of factors including employment status, and bank info to determine the credit worthiness of an individual vis-à-vis extension of loans.

Several factors can work for or against individuals seeking credit facilities in the United States, including:

- The number of credit inquiries

- The number of accounts and credit lines available

- Debt collections, public records, liens, judgments, collection agency notices etc.

Credit reports are created by the three major credit reporting agencies in the United States. These include TransUnion, Experian and Equifax. All financial transactions are reported to these bureaus, and it’s important to evaluate the accuracy of the information that has been collected and reported. Good credit scores on the FICO system are 850+, and the lowest scores are typically 300. Consistency of on-time payments, minimal use of credit facilities, a wide range of credit options (auto loans, mortgages, store credit, timely rental payments), and minimal credit inquiries are best for maintaining a better credit score. This serves clients well especially when banks are reluctant to issue credit to customers across the US.

What’s Likely to Happen?

US corporations are likely to hold back on big-ticket purchases and investments until they have further clarity about how the Trump administration is going to move forward with its plans on deregulation, tax reform, and healthcare. To date, the stock market has acted with abandon, racking up massive profits in the process. We are starting to see and unwinding of bank profitability, with dwindling share prices for leading banks like Wells Fargo & Company, Bank of America, Citibank, JP Morgan, Goldman Sachs and others. Nonetheless, an economic slowdown will ensue if sentiment does not improve. If Trump starts to rack up victories with the House and the Senate, markets will move bullishly. Rather than draining the swamp, Trump and his team are being sucked in by it and nothing is happening yet.

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million