Expectations for near-term economic growth have been scaled back as the rhetoric surrounding the trading relationship with China have heated up, while the heightened speculation about a trade war has sent the financial market reeling, according to a recent research report from Wells Fargo.

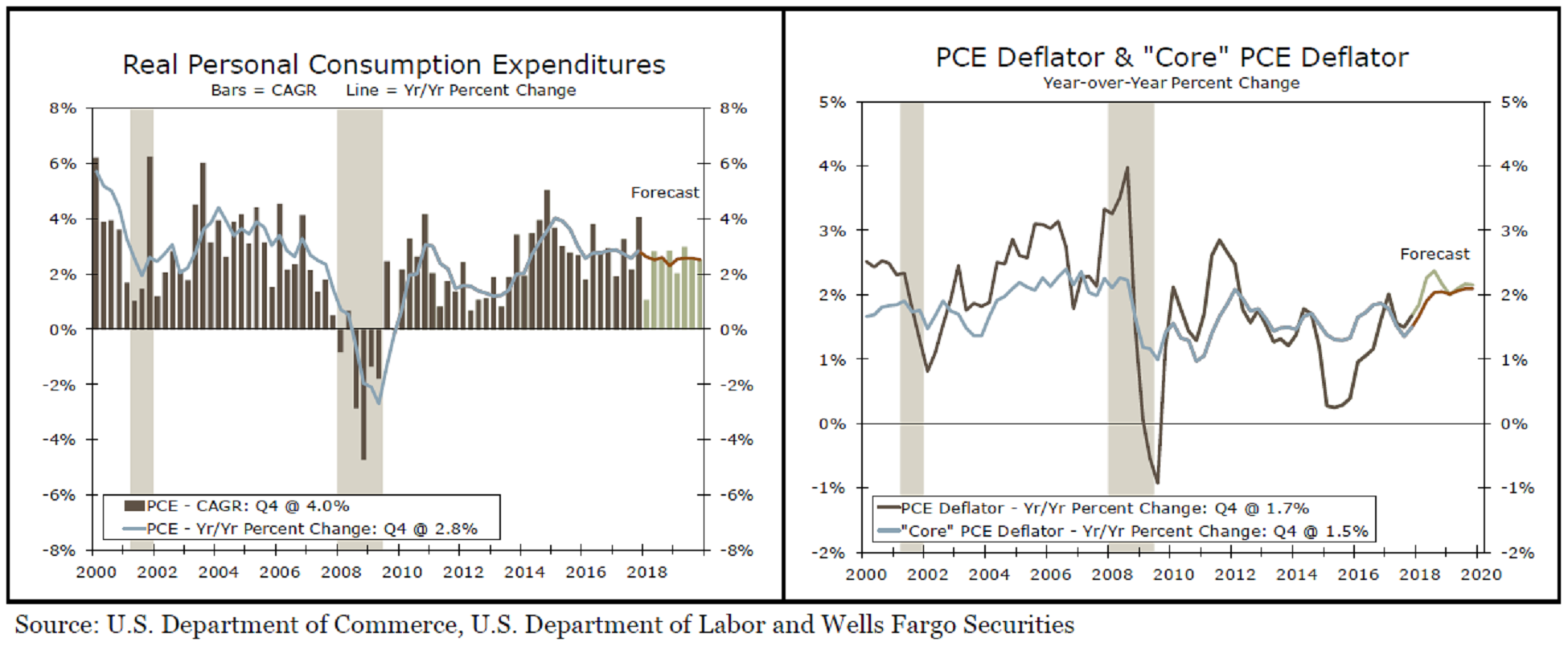

Pronouncements by both sides remain just words at this point. There is still plenty of time to reach a settlement before any actual trade restrictions would take effect. Estimates for first quarter real GDP growth have been ratcheted down for a more mundane reason – the weather. The first quarter saw more than its usual share of winter weather. The snowier weather weighed on consumer spending and construction.

The trade deficit also widened during the quarter and it is expected to subtract meaningfully from overall GDP growth. The apparent weak start to 2018 repeats an all-too-familiar pattern, where the first quarter has proven to be the weakest quarter of the year.

Growth is expected to bounce back this spring, however, and look for real GDP to average close to 3 percent through the end of the forecast period. Fiscal policy is now a potent tailwind and should boost consumer spending, business fixed investment and the public sector.

"The trade dispute and softer economic data slowed the rise in interest rates. We are still looking for three more quarter-point rate hikes from the Fed and look for the yield on the 10-Year Treasury Security to end the year around 3.20 percent," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices