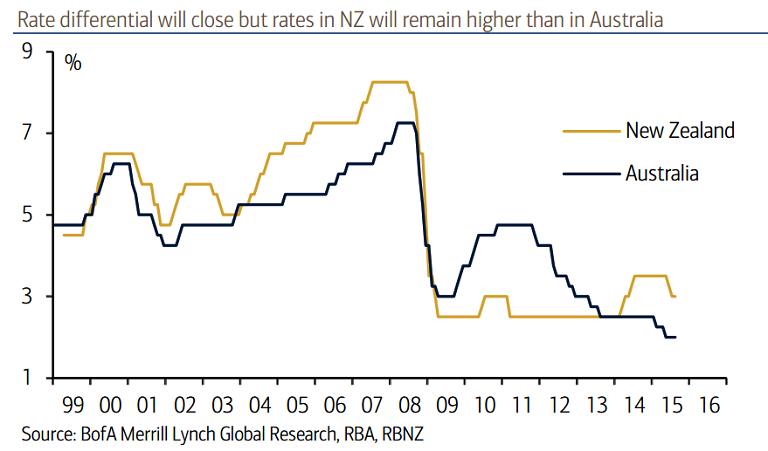

RBNZ is set to announce its rate decision on Thursday and it is almost certainly expected to cut the OCR by 25bps to 2.75%. Forecasts and language will probably imply one further OCR cut in October and RBNZ cuts depends on New Zealand data and the Fed's decision. By contrast, the RBA is becoming increasingly comfortable, at the prospect of leaving rates unchanged for an extended period. If anything, its easing bias is becoming slightly more neutral in its communications.

Markets are pricing another 25bp cut from the RBA by Feb 2016, whereas a 25bp cut by the RBNZ is fully priced in for Sept with a follow up by March 2016. RBA pricing looks more anomalous than the RBNZ. If the RBA does in fact ease rates again, it would likely do so by 50bp rather than 25bp. This is because it rarely fine tunes policy with one off moves.

"We expect the RBA will have rates at 2% and the RBNZ at 2.75% by the end of this year", says BoFA Merrill Lynch in a research note.

The AU rates market will continue to price in the risk the RBA will eventually be drawn into easing again due to external factors. Any further easing is unlikely to be just a 25bp move. Tighter financial conditions in the banking sector considering bank capital raisings and higher rates for housing investors means a rate cut is unlikely to be passed on in full.

So if there is still an argument for lower rates to support the growth outlook or help push the AUD lower again it would most likely be a similar pattern of 2x25bp cuts as in February and May of this year. It would require a particularly sharp deterioration in the domestic outlook to justify two follow-up cuts considering the low level of rates.

"We continue to view the current market pricing for the RBA "terminal rate" below 1.75%, or 25bp under the current cash rate, as representing a 50% probability of another 50bp easing", notes BoFA Merrill.

The risk for AUD remains biased to further near term downside as China's ongoing turmoil, its softened growth path, and the implications for commodity prices. Risk for NZD continues to be driven by broader volatility arising from China-related turbulence, with added pressure from narrowed interest rate differentials in the face of looming policy normalization at the US Fed, near term risk is likely to dominate.

New Zealand government bonds were unchanged on the day, with yields mostly flat along the curve. Australian government bond futures rose, with the three-year bond contract up 2 ticks at 98.240. The 10-year contract added 3.5 ticks to 97.3200. The Australian dollar dropped as low as $0.6960, its lowest since 2009, after key support of $0.6980 finally gave way. It was last at $0.6975. The New Zealand dollar fell in sympathy with the Aussie to $0.6365.

RBNZ likely to cut further while the RBA holds

Friday, September 4, 2015 11:09 AM UTC

Editor's Picks

- Market Data

Most Popular

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate