After lifting interest rates for a record nine times in a row, and flagging more raises still to come, the Reserve Bank of Australia’s latest set of forecasts make for grim reading.

The forecasts are part of the central bank’s quarterly Statement on Monetary Policy, its main communication (aside from interest rates) on how it sees the economy faring over coming few years.

The bad news is the bank tips economic growth to slow, inflation to remain high, spending to stagnate, unemployment to increase, and real wages to fall further.

The good news is that it could be wrong.

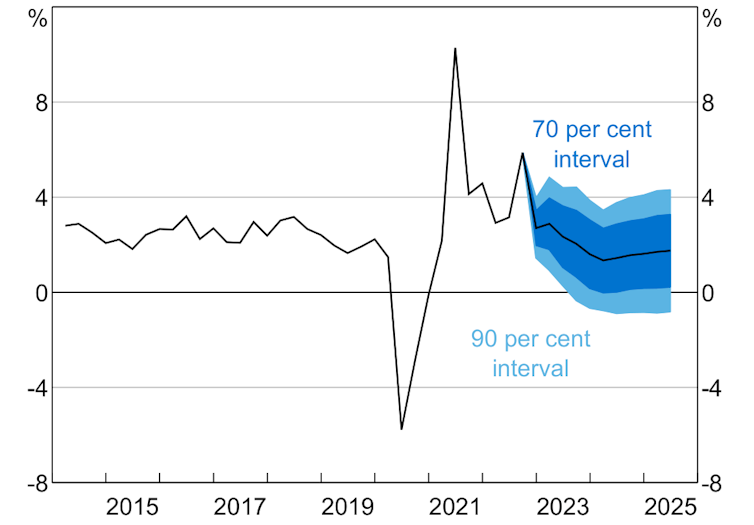

1. Growth is expected to slow

The central bank expects Australia’s economy to slow this year due to rising interest rates, higher cost of living, and declining house prices. It tips GDP growth for 2022 will be 2.75% (the Australian Bureau of Statistics won’t publish this data until March), and 1.5% over 2023 and 2024. This compares to the RBA’s expectation three months ago of 3% growth in 2022 but the same prediction for this year and the next.

RBA GDP growth forecasts

Confidence intervals reflect RBA forecast errors since 1993, year-ended forecasts. RBA

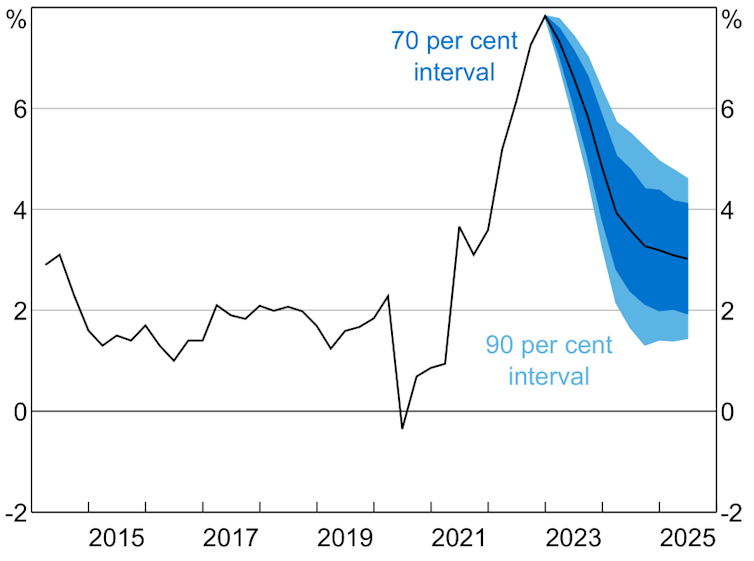

2. Inflation will remain high

The bank says inflation, which hit 7.8% in 2022, is likely to have peaked and predicts it will stay high for several months, but will decline to 4.5% by the end of 2023. By mid-2025 it should be back to 3% – the top end of the bank’s inflation target range of 2-3%.

RBA headline inflation forecasts

Confidence intervals reflect RBA forecasting errors since 1993. Year-end forecasts. RBA

However, the pace of this fall depends on wages and prices. The central bank acknowledges it could be quicker or slower. Its outlook for household spending is also uncertain, due to factors such as rising interest rates, higher inflation and declining housing prices.

Australia’s consumer price inflation has been high due to factors including global supply-chain disruptions caused by the pandemic, Russia’s invasion of Ukraine, strong domestic demand, a tight labour market, and capacity constraints.

The RBA expects rising energy prices will continue to drive inflation but that this will be offset by the federal government’s Energy Price Relief Plan, which involves price caps on gas and coal, and bill subsidies for households and businesses.

Price increases for goods such as food and furniture are expected to moderate. But the cost of services will continue to rise, due to wage growth.

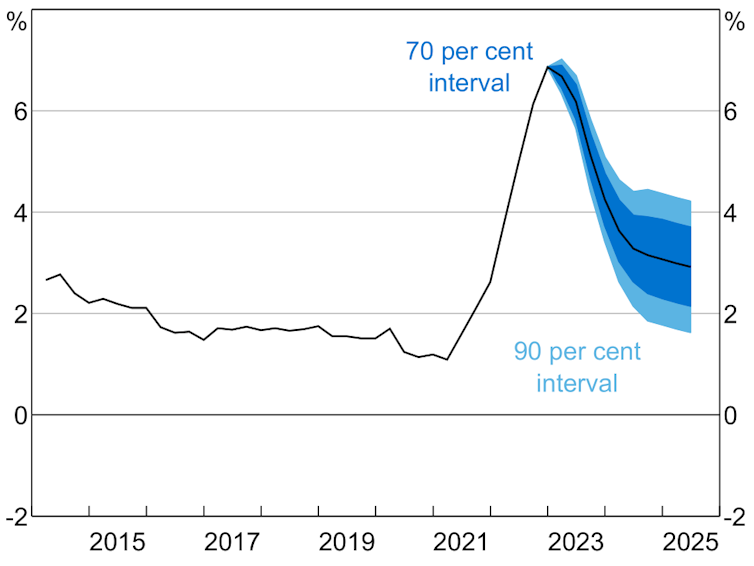

RBA inflation forecasts

Confidence intervals reflect RBA forecasting errors since 1993. Year-end forecasts. RBA

This is the main reason the RBA has flagged more interest rate hikes this year. It is determined to get inflation back to its target band, and will keep increasing borrowing rates until it is sure this goal will be achieved.

3. Household consumption will stagnate

The monetary policy statement expects higher consumer prices, higher interest payments and lower household net wealth to curb consumer spending in 2023.

But it expects spending to improve once interest rate rises stop, household wealth recovers and disposable incomes are boosted by tax cuts. The household saving ratio (which doubled during the pandemic) is expected to decline then increase, returning to pre-pandemic levels in 2024.

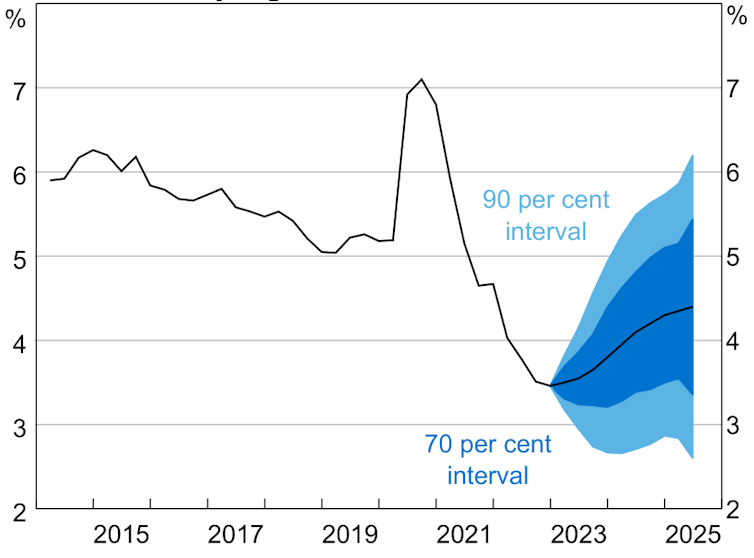

4. Unemployment will rise

The RBA expects the unemployment rate to remain at about 3.5% until mid-2023, and then to rise to 4.5% as demand for labour moderates.

RBA unemployment rate forecasts

Confidence intervals reflect RBA forecasting errors since 1993. RBA

Jobs growth is forecast to slow from 4.8% in 2022 to about 1% by mid-2024. Despite this, the participation rate in the labour force is not expected to fall, due to structural trends such as higher female and older worker participation.

5. Real wages will still fall

The RBA’s forecast for wages growth is now higher than three months ago, due to a tight labour market, higher staff turnover, higher inflation outcomes and Fair Work Commission wage decisions. It tips the Wage Price Index (WPI), which hasn’t been above 4% in a decade, to hit 4.25% in late 2023.

Given the inflation rate, however, this won’t be enough to stop real wages from continuing to fall. The WPI is then tipped to decline to 3.75% in mid-2025 as the demand for labour subsides and the unemployment rate rises.

Uncertainty remains high

These forecasts make for grim reading. But they could all be quite wrong.

As the saying goes, it’s tough to make predictions, especially about the future. Huge uncertainties hang over the global economy, including the war in Ukraine, the emergence of new COVID variants, and the unique challenges of recovering from the pandemic.

That means all these forecasts could be – and likely will be – wrong in one dimension or another. Even the RBA governor’s very clear message that there will be more interest rate rises this year could change if the prevailing circumstances do too. Only time will tell.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady