In what was a unanimous decision overnight, the US Federal Reserve raised its target range for the fed funds rate by 25 bps to 0.25-0.50%. The Fed's rate hike was the first in nearly a decade, which puts an end to a seven-year experiment with near-zero interest rates. Proceeding with great caution, Fed Chair Yellen said that "We have very low rates and we have made a very small move,". Both the FOMC statement and Yellen emphasized that the pace of tightening will be data dependent and likely be gradual.

The Fed's projections, released with its statement, show anticipation of federal funds rate of 1.4 percent by the end of 2016, which implies four interest rate increases in 2016, or one per quarter. Some had expected the Fed to scale back its forecast for the pace of its interest-rate hikes, but the Fed's expected path still implies a more gradual tightening cycle than previous efforts.

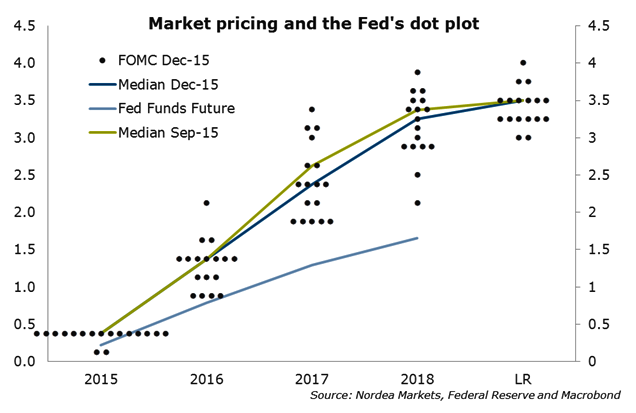

FOMC statement has paved a clear baseline for additional rate hikes, rather than signalling "one-and-done". While the median FOMC forecast for the fed funds rate by end-2016 remained at 1.375%, the end-2017 and end-2018 medians were revised slightly down, by 25 bp and 12.5 bp respectively. The median projection for the longer-run neutral fed funds rate remained at 3.50%.

The FOMC's median projections for real GDP growth, unemployment and inflation were only modestly revised. In its most recent projections, the Fed lowered its expectation for 2016 core inflation growth to 1.6 percent, down from its previous 1.7 percent expectation. The median FOMC estimate of the NAIRU - the unemployment rate consistent with full employment - was unchanged at 4.9%.

Markets at present priced in for about two hikes in 2016 compared with four hikes in the FOMC's dot plot. The rising inflation pressures will imply that the pace of Fed tightening during 2016 will be faster than is currently priced in by markets.

"We believe the Fed will hike rates again in March. At this juncture, we do not expect the Fed to start letting its balance sheet shrink until H2 2016 at the earliest", says Nordea Research in a report.

Stock markets across the globe edged higher post Fed decision. USD was also stronger across the board after the initial turbulence settled down. USD/JPY was trading at 122.43 and EUR/USD was at 1.0846 as of 1140 GMT. U.S. stock index futures were up more than 0.3 percent; Nasdaq futures up about 0.45 percent, pointing further gains in US markets today.

Pace of Fed tightening in 2016 will be faster than markets price-in

Thursday, December 17, 2015 12:04 PM UTC

Editor's Picks

- Market Data

Most Popular

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell