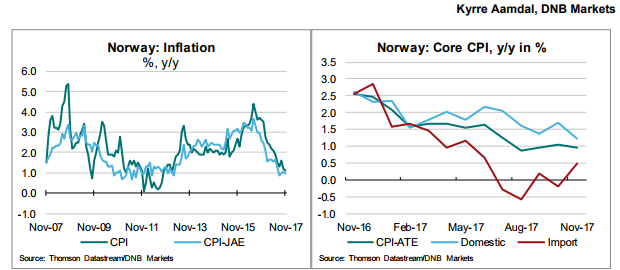

Norway’s core inflation in November fell only 0.1 percentage point from October, but was clearly weaker than expected. One reason was the highly volatile air fares, but food prices have developed weaker than normal since summer.

The weakening of the NOK may contribute to lift imported inflation during the spring next year, but if NOK again appreciate and with the outlook for modest wage growth, Norges Bank will face difficulties in lifting inflation to the target over the next years. We expect therefore Norges Bank to lag the ECB and increase rates in Q3 2019.

Regarding Norges Bank’s monetary policy meeting this week, the cutoff date for the projections was probably last Friday and today’s figures will not affected the presented rate path. If so, Norges Bank will probably present a rate path indicating rate hike early 2019. But today’s figures are arguments for a lower rate path and if accounted for will make it easier for Norges Bank to present only a moderate increase in the rate path.

Domestic core inflation fell from 1.6 percent y/y in October to 1.2 percent in November, partly pulled down by falling food prices. Imported inflation rose to 0.5 percent y/y in November from -0.2 percent in October. Higher prices on clothing pulled imported inflation higher. Total inflation (CPI) was 1.1 percent y/y in November. Norges Bank projected 1.4 percent in its September report. Electricity prices rose 8.1 percent m/m and fuels rose 6 percent m/m.

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock