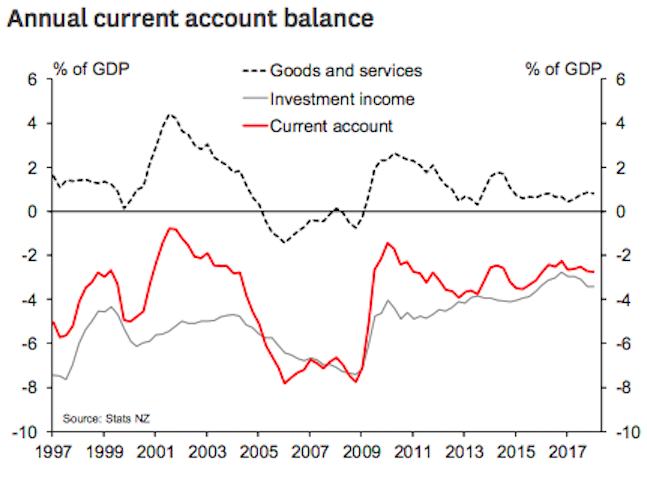

New Zealand’s current account deficit widened slightly to 2.8 percent of GDP in the year to March. While this was the largest deficit in two years, it remains low relative to history. The result was in line with expectations, and has no implications for our other economic forecasts.

In seasonally adjusted terms, the quarterly deficit increased substantially in March, reaching just over USD3 billion – the biggest in nine years. The main factor was a widening in the trade deficit for goods. The value of exports fell by 5.9 percent, while imports rose by 2.4 percent.

However, the softness in exports is expected to be reversed next quarter. Export commodity prices have improved since March, and the volatility in export volumes is often a product of the timing of shipments.

The rise in imports was mostly due to prices, with world oil prices higher and the New Zealand dollar weaker over the quarter. But import volumes held steady after a sharp rise in the previous quarter, particularly for imports of plant and machinery.

"We’ve been anticipating some slowdown in business investment this year, in line with the drop in business confidence. But there is little evidence for an investment slowdown yet, at least in the trade figures," Westpac Research commented in its latest report.

Meanwhile, New Zealand’s relatively small current account deficits in recent years mean that its overseas borrowing requirement has been much smaller than in the past. Indeed, the New Zealand economy has effectively been able to outgrow its debts.

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed