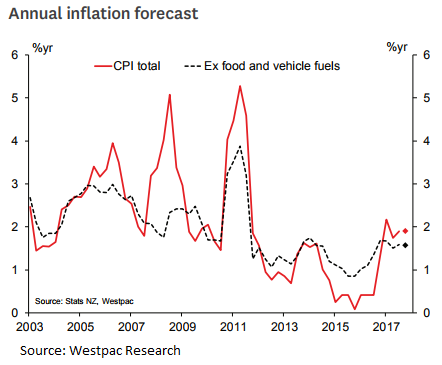

New Zealand’s consumer prices are expected to have risen by 0.4 percent in the December quarter, led by higher fuel prices and other transport costs. This would maintain the annual inflation rate at 1.9 percent, very near to the 2 percent midpoint of the Reserve Bank of New Zealand’s (RBNZ) target range. Excluding the volatile food and fuel categories, annual inflation is seen to remain at a more modest 1.6 percent, Westpac Research reported.

The most significant price increases over the December quarter were related to travel. Petrol prices were up 6 percent over the quarter, and diesel prices rose 10 percent, reflecting a rise in world oil prices and a weaker New Zealand dollar. Petrol prices are at their highest since the September 2015 quarter.

The largest negative contribution will be from a 1.6 percent drop in food prices, led by an 18 percent drop in vegetable prices. This is entirely a seasonal phenomenon – in seasonally adjusted terms, food prices are expected to be up 0.3 percent for the quarter. Food price inflation picked up over 2017, but much of that was due to poor weather playing havoc with some crops.

"Aside from fuel and food, we expect that tradables prices remained subdued. It’s likely that the rise in the New Zealand dollar earlier in 2017 was still suppressing import prices at the end of last year," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market