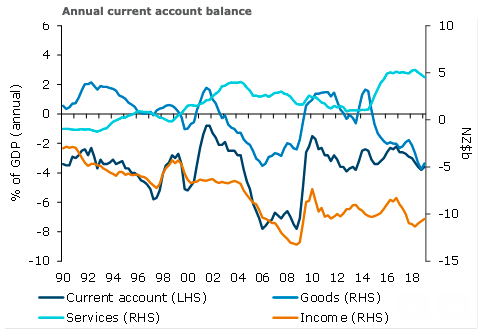

New Zealand’s annual current account deficit narrowed $0.6 billion from an upwardly revised Q4 to $10.6 billion in Q1. This saw the current account deficit as a share of GDP narrow from 3.8 percent to 3.6 percent, which is in line with its historical average.

As is typically the case, the unadjusted quarterly current account transitioned from deficit in Q4 to surplus in Q1 (from -$3.5 billion to $0.7 billion). This was slightly larger than the $0.2 billion surplus we had pencilled in. Much of the variance seems timing related, with revisions appearing to capture a large chunk.

The goods deficit flipped into surplus, reflecting an unwinding in seasonal import demand over the summer months and as exports remained robust on the back of still-high prices and solid agricultural production in recent quarters.

While the OTI terms of trade suggest goods export prices did indeed fall in Q1, this was by less than the decline in import prices, with the net impact on the trade balance being positive.

The unadjusted services surplus widened from $1.0 billion in Q4 to $3.0 billion in Q1 as imports dipped (fewer kiwis go on overseas holidays when the weather back home is good) and exports lifted, reflecting the usual seasonal peak international tourism demand.

In seasonally adjusted terms, the current account deficit was broadly stable in Q1, narrowing by just $60 million. A smaller goods deficit (on slightly softer imports) was offset by a smaller services surplus, which shrank by around $0.1 billion on the back of higher services imports.

As expected, New Zealand’s net international liability position (NILP) improved (by $4.0 billion to $164.4 billion), largely reflecting a rebound in the value of offshore assets following Q4’s downward revaluation on the back of the global equity wobble late last year. As a share of GDP the NILP fell 1.9 percentage points to 55.5 percent.

Image courtesy: ANZ Research

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances