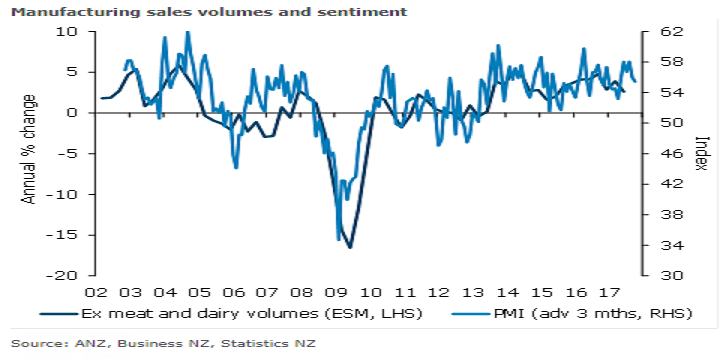

Manufacturing sales volumes in New Zealand rose during the June-quarter by 1 percent q/q after two-quarters of declines. There were strong gains in meat and dairy volumes, as well as other food and beverages. However, there were declines in most of the non-food categories, including a reversal of the sharp jump in transport and machinery that had boosted the March quarter.

Stripping out the meat and dairy impact, ‘core’ sales volumes fell 0.2 percent q/q, after a lift of 1.5 percent q/q in Q1. Of the 12 core industries, seven recorded higher sales volumes, while five experienced falls. Petroleum and coal product manufacturing (-10.4 percent q/q) and chemical, polymer and rubber product manufacturing (-7.9 percent q/q) were the biggest drags (reversing opposite moves in Q1).

"Nonetheless it reinforces further downside risk to our Q2 GDP expectations (currently +1.0 percent q/q). We already saw downside risk following the softer-than-expected building work data earlier in the week. Today’s figures add to that," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record