New Zealand’s headline CPI is expected to have remained flat in the December quarter, with annual inflation slipping from 1.9 percent to 1.8 percent. Tradable inflation is expected to print at -0.8 percent q/q, while non-tradable inflation is expected to post a 0.4 percent q/q rise, according to the latest report from ANZ Research.

The RBNZ may take a degree of comfort from the fact that Q4 weakness is expected to be concentrated in tradable inflation. But the medium-term outlook for domestic inflation is more troubling. The RBNZ needs to see accelerating GDP growth to achieve a sustained lift in inflation, and the prospect of that is slipping away.

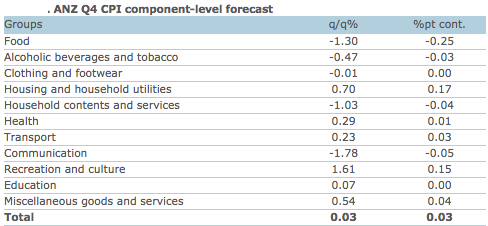

Food prices are expected to provide their usual seasonal drag, which fell 1.3 percent q/q in the quarter and alcoholic beverages also saw seasonal declines. Together, these are expected to detract 0.3 percentage point.

Further, durable prices look set to drag in the quarter, reflecting seasonal sales and continued weakness in retail prices, in part due to weak import prices. The same factors are also contributing to non-existent inflation in apparel prices. Communications prices are also expected to continue to decline, dragging on inflation. These forces together are expected to subtract 0.1 percentage point from inflation.

Also, housing-related prices continue to support domestic inflation. Rents are forecast to increase 0.6 percent q/q and purchase of housing is expected to increase 1.3 percent q/q, with smaller contributions from property maintenance and higher electricity prices. The household and household utilities group is expected to boost CPI inflation by 0.2 percentage point.

Accommodation prices will see seasonal strength. Accommodation prices are expected to have risen 6.9 percentage, contributing 0.2 percentage point.

"On the whole, we see risks to our flat Q4 CPI forecast as balanced. There is scope for an even lower tradable inflation outturn, reflecting weakness in imported prices and pass-through of lower petrol prices. On the other hand, there is scope for an upside surprise on non-tradable inflation if rents increase more than expected, as signalled by our ANZ Monthly Inflation Gauge," the report added.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out