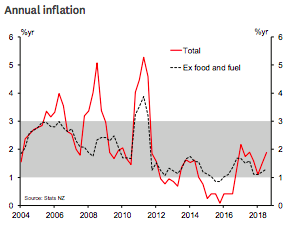

New Zealand’s consumer price pressures proved to be a little stronger than expected in the September quarter. The CPI rose by 0.9 percent q/q, beating the 0.7 percent q/q rise that the markets were expecting, and well ahead of the 0.4 percent rise that the Reserve Bank forecast in its August Monetary Policy Statement. The annual inflation rate picked up from 1.5 percent to 1.9 percent, its highest in a year.

Fuel prices accounted for about a third of the increase in the CPI for the quarter, and are likely to push annual inflation above 2 percent in the next quarter. Looking past the direct impact of fuel price rises, underlying inflation has continued to tick up at a gradual pace, though on most measures it remains in the lower half of the RBNZ’s target range.

Further, the index also tends to get a small boost from seasonal factors in the September quarter, such as food (especially vegetables), airfares and local body rates. Even so, Stats NZ estimates that seasonally adjusted prices rose by 0.8 percent, which is the largest quarterly increase since a 0.9 percent rise in March last year.

Aside from fuel, there was a modest rise in the prices of tradables such as household contents. Non-tradables prices rose by 0.8 percent in the quarter, stronger than Westpac Research’s forecast (and the RBNZ’s) of a 0.6 percent rise. Dwelling-related costs accounted for much of the increase, with new home construction up 1.3 percent and home insurance up 4.4 percent.

"The most significant surprise for us was in accommodation, which was about flat for the quarter and up 6.2 percent on a year ago. Combined with other recent developments, we think that the odds of an OCR cut in the next year are reducing," Westpac Research commented in its latest report.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk