The Mexican Peso has started 2017 firmly on the back foot. MXN hit new all-time lows against the USD, above 22 levels on January 11th ahead of US President-Elect Trump's first press conference since election. The pressure on the currency has largely been a result of Trump encouraging the US auto industry to produce vehicles domestically. Reactions have been starting to be felt, with Ford scrapping its plans to build a $1.6bn plant in Mexico.

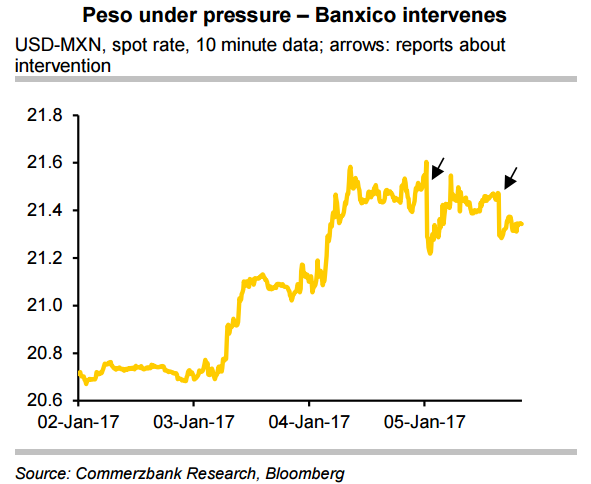

The extensive currency weakness has triggered Banxico to intervene directly in the FX market, but the central bank has had limited success in stemming losses. The central bank did not disclose the amount, however, Reuters reported that the central bank sold about USD 1 billion from its FX reserves. Uncertainty about the economic outlook justifies a weak Peso and the central bank cannot intervene indefinitely.

With intervention the Banxico has not been able to prevent the peso from depreciating. Rate hikes should be a better tool, and the Mexican central bank already demonstrated last year that it is willing to use it. The central bank raised interest rates five times in 2016. Should depreciation pressure on the peso remain high in the coming weeks, the central bank will likely raise its key rate once more at its meeting on 9 February.

The risk profile for the MXN is believed to be slightly skewed at these levels. The Bank of Mexico cannot tolerate additional weakening from the already extremely weak levels, added Nordea Bank. The support by central bank is expected if Trump comes through with some of his anti-Mexico election promises. But if Trump softens his stance, MXN might be the best performing EM currency in 2017, according to Nordea Bank.

The Trump presidency streaking toward Mexico is already causing problems. Inflation has started rising in response to the devaluation of the peso. After a sharp rise in public debt as a share of GDP over the past several years, the government must curb spending. Over the past few months economists have lowered their forecasts for GDP growth in 2017, from an average of 2.3 percent to 1.4 percent. On January 1st the government cut a popular subsidy by raising petrol prices by up to 20 percent, causing widespread protests.

"Prospects for the Mexican economy are becoming increasingly cloudy. A variety of metrics suggest that the MXN is undervalued and we forecast a gentle decline in USD/MXN, to 19.50 by mid-year" says Lloyds Bank in a report.

USD/MXN has eased slightly from record highs at 22.03 on Jan 11th. The pair was trading at 21.79 at the time of writing at around 0630 GMT. At the same time FxWirePro's Currency Strength Index showed Hourly USD Spot Index was at -41.2598 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings