This week, Reserve Bank of India (RBI) led by eminent economist Raghuram Rajan took unprecedented step to reduce policy rates by 50 basis points (bps) compared to market expectations of just 25 bps.

RBI pointed at lower inflation giving it ample room to tackle headwinds from China, slowdown in exports and weaker corporate investments with greater policy easing.

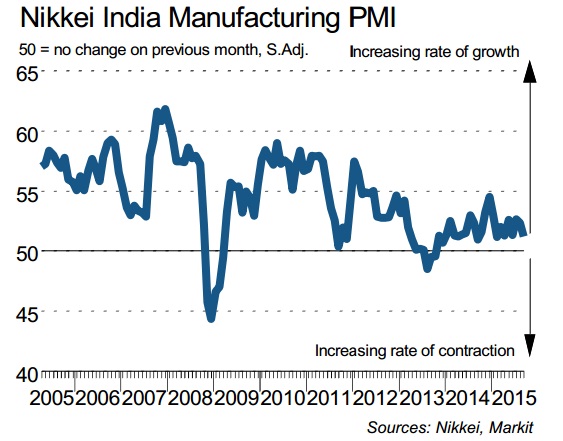

Today manufacturing PMI report suggests RBI may have done the right thing.

- India's manufacturing PMI dropped to 51.2, seven month low, down from 52.3 in August.

- Business is increasing at slower rate, reducing output of firms.

- Business from abroad grew at slowest pace in 24 months.

- Purchasing activity rose at weakest pace since December 2013.

- PMI report overall was pretty bad with slower increase in new orders leading to reduction in employment.

Though both economist and market participants agree that India is in much better position than most of it emerging market peers including China, but it is not insulated to further slowdown in China and rout in commodity prices.

Greater concerns are corporate debt levels and higher non-performing assets at the banks.

Indian Rupee however is well bid since RBI reduced rates. INR is currently trading at 65.5, down just 4% against Dollar, so far this year.

Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum

Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  BTC Dips on Trade Tension Ease, But 450 BTC/Day Whale Says “Buy More” – Eyes $107K Glory

BTC Dips on Trade Tension Ease, But 450 BTC/Day Whale Says “Buy More” – Eyes $107K Glory  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Morgan Stanley Flags High Volatility Ahead for Tesla Stock on Robotaxi and AI Updates

Morgan Stanley Flags High Volatility Ahead for Tesla Stock on Robotaxi and AI Updates