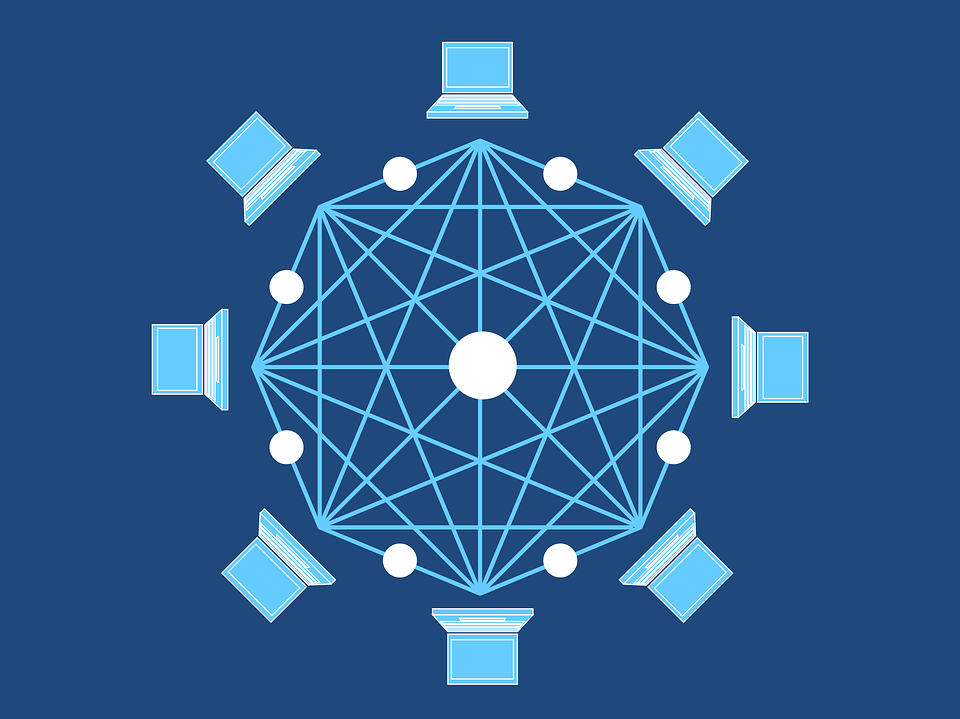

IHS Markit is reportedly creating a new blockchain-centered platform to facilitate the payments leg of syndicated loan trade, which will eventually transition to other financial negotiations. Called Stax, this collection of wallets and smart contracts aims to remove the last process of wire transfers, where each dealing has its own wire.

"It's not always about reducing time; for us, it's about reducing work," said John Olesky, the company’s managing director and the head of product management. "If we can take something that involves 10 steps down to seven, great."

Should everything go swimmingly, the system will be able to eliminate workload around cash transfer between two groups involved in a syndicated loan, according to CoinDesk. The traditional process of such method usually requires collaborating with as many as 30 different banks. The London-based company seeks to conduct its first preliminary run this summer.

IHS Markit is looking to store fiat money in a traditional trading account and use digital wallets to represent it via a token form. IHS bank customers will be able to wire deposits into a conventional account where the amount is converted into a digital token in a private network. As the tokens are stored in the wallet, this will then allow customers to settle certain trades.

Olesky told Coindesk that they can complete transactions 24 hours a day by eliminating the wires, thus reducing time and effort. "We don't think that wire system procedures, technology, and uptime should be barriers anymore,” the managing director added.

Syndicated loans are estimated to be at a $1 trillion issuance on a yearly basis, most of which are settled through the company’s loan solutions system. Despite using the blockchain tech, which can drastically reduce trade transactions, the IHS Markit’s system will still take up 20 days to be completed.

This is due to the smart contracts deciding if the trade is primed for closure and will perform the monetary transfer. The delay is also in some way intentional since a lot of factors are still being factored in, such as primary issuance, secondary transactions, changing of interest rates and more.

This announcement will certainly thrill crypto enthusiasts as more and more big-wigs are coming in to play in the digital space. But a lot of investors out there are still wary to integrate blockchain into their system. Nevertheless, the fear is lessening, with each company dipping their hands in the crypto space.

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment