On Friday, Fed Chairwoman Janet Yellen said during a panel discussion at Harvard University that the central bank would “probably” raise interest rates in the coming months if the economy picks up as expected and jobs continue to be generated. After several FOMC members had gradually prepared the market for such a step the confirmation by chair Yellen was the last piece in the jigsaw puzzle.

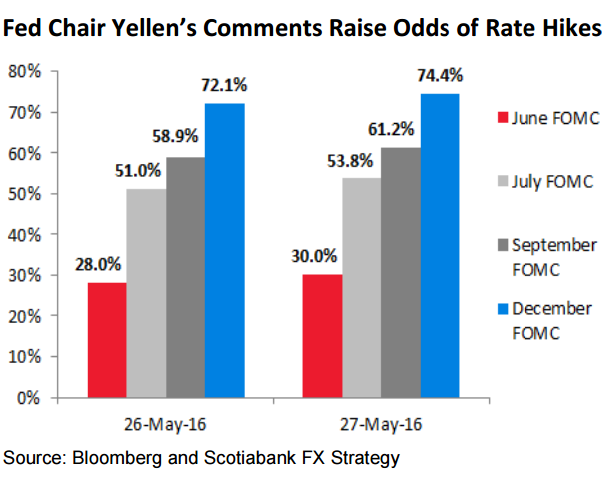

Fed Chair Yellen’s comments raise the odds of rate hikes in June-July months. Although Yellen expressed caution about too steep a rise in U.S. rates, she sounded more confident than she has in the past that the U.S. economy has rebounded from a weak winter and that inflation would edge higher toward the Fed's 2 percent target.

Fed will make its rate decisions heavily dependent on the economic data and USD-levels. Important data to be released this week include Non-farm payrolls and PCE-inflation index. Expectations are for Non-farm payrolls likely below 200k in May, Core PCE-inflation likely a bit lower in April with inflation expectations fairly stable and a possible manufacturing ISM dip below 50 in May.

The macro-economic score probably edged down in May, but outlook for the US is more optimistic. The negative factors for the US economy are likely to ease over the coming months. Private consumption is expected to pick up notably over the coming months which will support growth. Several Fed members in recent weeks have said the central bank is preparing to follow up on an initial policy tightening in December.

"We think a Fed rate hike in July is more likely by considering Brexit Referendum scheduled for 23 June and Spanish General Election due on 26 June, followed by another interest rate increase at December FOMC meeting," said Scotiabank in a report.

Most emerging Asian currencies lost ground on Monday after Federal Reserve Chair Janet Yellen bolstered expectations of an near-term U.S. interest rate hike. Prices for U.S. Treasuries fell after Yellen's remarks, while stocks rose. The U.S. dollar index edged higher against a basket of currencies and was trading at 95.70 at 1200 GMT after hitting highs of 95.97.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate