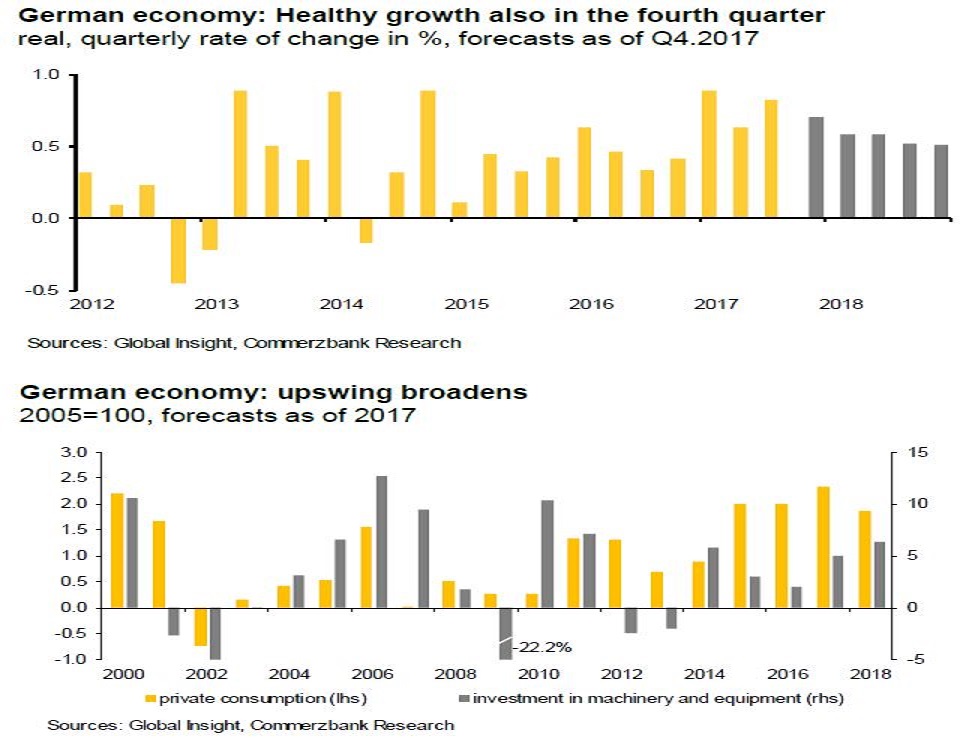

The German economy is expected to grow by 2.5 percent this year after having expanded strongly in 2017 at an expected rate of 2.3 percent. Private consumption is likely to remain the main driver of the economy, benefitting from rising employment and decent wage increases. In addition, the improving investment in machinery and equipment is also expected to widen the upswing, Commerzbank reported.

The upturn in the global economy, favorable financing conditions and, last but not least, increasing capacity bottlenecks mean that companies are once again investing more. Further impetus is likely to come from construction investments, fuelled by the high demand for real estate.

The German economy has grown far more over the past ten years than the average of other eurozone countries, but this situation will come to an end in the longer term. One of the pillars of German success in recent years – its strong price competitiveness – is wobbling. German unit labor costs, for example, has been rising since 2011 more than the average in other eurozone countries.

Meanwhile, Germany has lost attractiveness as a business location in past years. Its distance from a hypothetical top location in the EU has steadily increased. Especially eastern European countries have implemented much more reform. Germany as a business location has slipped to rank 16 out of 28 EU countries.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions