The EURUSD exchange rate has stabilized below 1.23 for now. Despite all the EUR positive news over the past few days, we see the USD weakness as the decisive driver for the general uptrend in EURUSD.

The largest G10 movers since our last write up in October have been euro (outperformed) and Sterling, while the underperformers were loonie and Scandis (unchanged vs USD). The dollar has declined largely against all G10 crosses since then, weakening 1.3% in TWI terms.

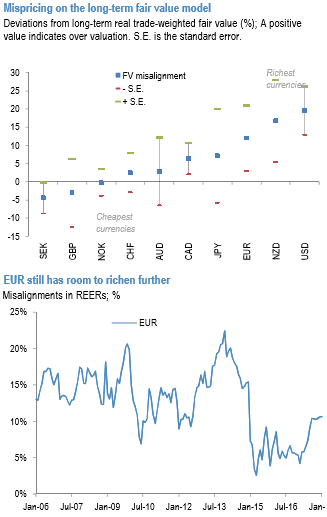

These moves have resulted in only modest changes in the overall rich/cheap ranking of G10 currencies. Despite the underperformance, USD still remains among the richest currencies in the sector (refer above chart).

Buy dual digital call on EURUSD and USD rates:

With the correlation between EURUSD and USD 10y rates negative (-30% in the past six months, (refer above chart)) a dual digital pay-off requiring both of them to move up should cheapen. Thanks to the negative correlation between EURUSD and the USD 10y rate, this hybrid option is cheaper than the product of the individual digital call premiums.

EUR outperformance is noteworthy and while it has moved up the ranks, it still has room to strengthen further. It is only the third richest currency on this framework (refer above chart) and while EUR typically tends to persistently screen rich on this framework, this overshoot is far from extreme (refer above chart) leaving ample room for further strengthening if the ECB continues to become less dovish.

Buying the usually negative correlation between EURUSD and dollar rates does not mean that it must become positive for the trade to perform. Correlations are computed between short-term returns, so EURUSD and the USD 10y CMS could rise together even if the correlation stays negative.

How sustainable the levels above 1.20 would, therefore, be depended mainly on whether the weakness continues or not. We consider any further appreciation potential on the euro side of things to be limited. All hawkish comments from members of the ECB, like the one by the Estonian central bank governor Ardo Hansson yesterday, were always based on the condition of a significant rise in underlying price pressure over the coming months. Courtesy: JPM

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close