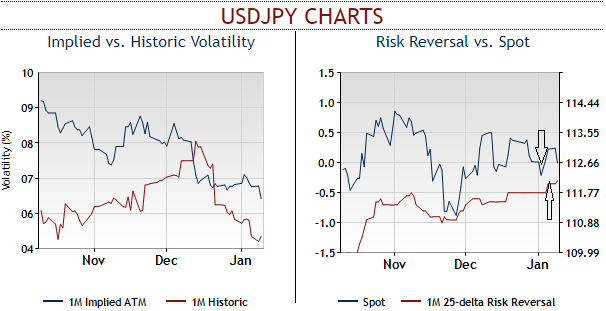

Yen vols (IVs) have been decimated and RVs are not in tandem with this over the past two months. Well, long-end (1Y –5Y) yen vols dropped in near-parallel fashion in December by a full vol across the curve (refer 1st chart), representing a > 1-sigma monthly decline that cannot be explained the softening in realized vols alone (refer above chart).

It is true that USDJPY spot has delivered precious little excitement within a narrow 112 –113.50 range since November, but the magnitude of the vol move is nonetheless surprising for two reasons:

1) Initial levels of vol and flatness of the vol curve were among some of the most depressed in history, and

2) Back-end USDJPY forwards sold-off to a greater degree than shorter-dated as wider US –Japan rate differentials pushed forward points further to the left without an offsetting rally in spot; lower USDJPY forwards is, of course, the direction of higher, not lower volatility according to risk-reversals that are solidly bid for USD puts/JPY calls.

Put spreads: We’ve already advocated this options strategy in the recent past as we could foresee only a small chance of that commitment waning in 2018 because the inflation rate won’t get anywhere near 2%, but the net result is a huge skew in the range of outcomes for the USDJPY.

Buy USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 112.676)

A USDJPY 1y put spread strikes 106/103 would cost 0.75%, thus providing a maximum payoff of 3.9 times the premium. Setting a global KI at 116 more than halves the price to provide leverage reaching 8.8 at 103 in one year.

Selling USDJPY 1y skew: In selling downside strikes, buy USDJPY puts is paying for the negative skew of low strikes. As we don’t foresee USDJPY crumpling below 100, needless to buy the total downside. Accordingly, we also finance our puts by selling the downside skew via put spreads.

In setting a topside knock-in, near-term, USDJPY should be initially mildly supported by mounting US yields. This suggests conditioning medium-term put spreads by a topside knock-in. Such a barrier will cheapen the vanilla trade, as the bearish skew discounts the market implied the probability of bullish moves.

Currency Strength Index: FxWirePro's hourly USD spot index is showing 69 (which is bullish), while hourly JPY spot index was at 147 (bullish) while articulating at 12:08 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings