Both in the euro area and in the US, new PMI readings have been the center attention for today as the level of a diffusion index based on surveyed purchasing managers in the services industry. What makes the PMIs interesting is that they should confirm the mix of hopes and doubts which have pushed the EUR-USD exchange rate up almost to its 2-year high (just above 1.17 in August 2015). Both French and German PMIs of both manufacturing and services sectors have missed the forecasts and dipped from previous flashes:

In Germany:

Manufacturing PMIs – actual 58.3 versus f/c at 59.1 and previous – 59.6

Service PMIs – actual 53.5 versus f/c at 54.4 and previous – 54.0

In France:

Manufacturing PMIs – actual 55.4 versus f/c at 54.6 and previous – 54.8

Service PMIs – actual 55.9 versus f/c at 56.6 and previous - 56.9

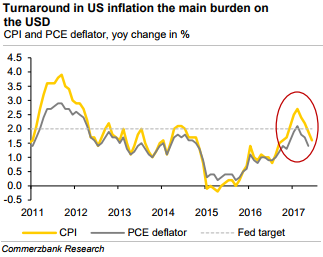

Market participants hope that robust euro-area growth will enable the ECB to turn away from the ultra-expansionary emergency monetary policy it pursued during the crisis years, and they doubt that the Fed will soon hike the Fed funds rate further against the background of recently disappointing inflation (refer above chart).

Euro area PMIs to soften further: A slow start to the week, with PMI surveys the main focus. We expect the euro area PMI to fall further in July to 56 as a result of moderation in the French index and stabilization in Germany.

The agenda for the rest of the week will include business surveys in Germany and France, as well as euro area M3. The climax will be on Friday when we get the first estimates of 2Q'17 GDP growth for France and Spain, a batch of national inflation reports for July (Germany, France, and Spain) and the EC economic confidence indicator.

Euro PMIs to soften further: The euro area composite PMI already exhibited some signs of moderation in June, when it fell 0.5 points to 56.3. We expect the euro area composite PMI to drop further in July to 56.0.

Nevertheless, this index level would still point to solid GDP growth of around 0.6% qoq, or 2.4% in annualized terms, in 2Q’17, based on econometric models estimated since the crisis.

The econometric models estimated since 1998 would even point to firmer GDP growth at 2.8% in annualized terms. In our opinion, the fundamentals of the euro area economy are slightly less solid (as per Societe Generale’s GDP growth forecasts for this year and next stand at a respective 2.1% and 1.7%), and this why we expect business surveys to soften over the coming months.

As EURUSD (spot reference: 1.1650) edges higher at 2-years highs, even though it’s been trading a bit resilient for today, we advocate staying long in cash and also add a 2m call as the market interprets Draghi’s lack of protest as consent for EUR bulls. Subsidize EURUSD upside by selling an EURNOK call to fade the systematic overpricing of the correlation between EURUSD and EUR/European crosses.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings