Today many analysts will give in to the temptation of putting the impressive collapse of the USD we are currently seeing down to the small changes in the FOMC statement.

Well, the changes related to (a) the planned reduction of the Fed balance, a process that had been announced and expected, and (b) the description of the status quo. No, that is not enough to explain any dramatic moves in USDJPY.

Bearish USDJPY scenarios:

1) Fed doesn’t tighten again in 2017 or allow the balance sheet run-off to begin.

2) Chinese growth turns higher in Q3 and Q4, compared to consensus expectations of stability or modest slowing.

3) Non-US central banks turn increasingly hawkish into year-end.

On the other hand, the Japanese central bank doesn’t seem to hint any change in policy stance.

We could foresee USDJPY to hit 105 levels by Q1’2018 given:

1) The global investors’ risk aversion heightens significantly, possibly due to deterioration in North Korea situation and/or US-Japan trade frictions.

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness.

OTC indications and options strategy:

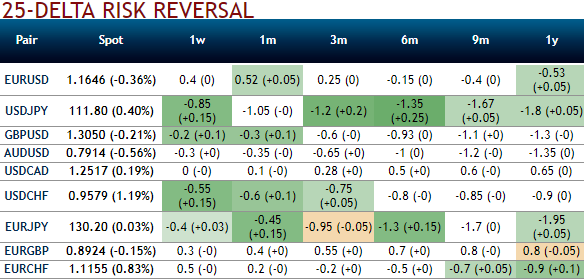

Please be noted that the nutshell above showing delta risk reversals for USDJPY has been flashing highest negative numbers among the G10 FX space. While IV skews of 1m tenors have also been indicating mounting bearish risks as the IVs have been positively skewed on OTM put strikes.

We reckon the below OTC indications and trend in USDJPY seems to be reasonably addressed by bearish hedging participants, hence, we advocate below option strategy to mitigate the uncertainty hovering for downside risks, the strategy likely to keep underlying price risk in check regardless of price swings with cost effectiveness.

Please be noted that the OTC markets for this underlying pair have been indicating the mounting bearish hedging sentiments in both short and long run (see risk reversals through 1w to 1y tenors).

For aggressive bears, buy a USDJPY debit put spread, 2m/1m 112.50 – 108.700.

For risk averse hedgers, buy USDJPY 1Y ATM straddle. Monetize erratic shifts in US policy focus at minimal carrying costs.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data