USD drops on US-China trade optimism, FX markets await Fed and nonfarm. Primarily, the FOMC outcome later this week for clues on direction. Additionally, the BoJ and BoC hold meetings this week, although neither is expected to adjust policy at this time.

The USD turned higher last week, consolidating three weeks of losses but gains were not enough to suggest a reversal in USD softness overall and we still rather feel the USD is vulnerable to more weakness ahead regardless of more usual pro-dollar seasonal trends that are usually in play at the moment. We look for quiet trade initially this week as markets await developments on politics, policy and data.

While CAD follows broad dollar weakness; BoC widely expected to hold on Wednesday. The CAD ignored the election result (no surprise) and some soft data last week to power on and close the week out as the top G-10 performer overall, with a 0.5% rise against a generally firm USD. The CAD’s ability to rally, despite some headwinds, suggests something of a change in tone for the CAD, which has struggled to match fundamentals since mid-year. We look for additional gains in the near-term to test the 1.30 area but much will hinge on central bank developments this week. We expect a “neutral hold” decision form the BoC but characterizing the Fed outcome is a little harder. We think the Fed will need to leave the door open for further rate cuts in the next few months for the CAD rally to extend; a “hawkish cut” which would imply the Fed’s mid-term adjustment is over would lift the USD.

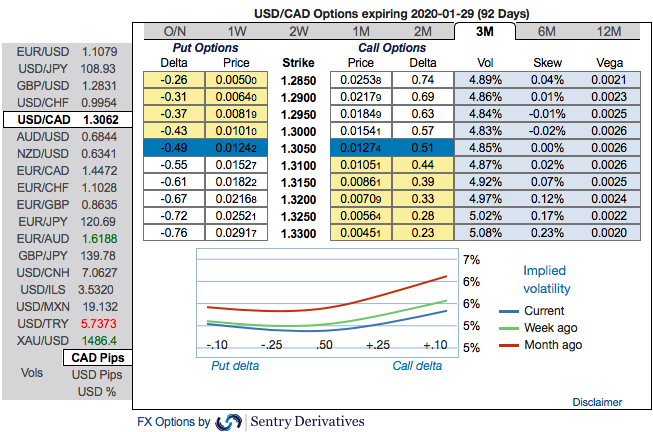

Hence, it is wise to capitalize on USDCAD Interim Dips, and bid short-tenured risk reversals and 3m IVs to optimize hedging strategies.

Options Trades Recommendation: At spot reference: 1.3063 level while articulating, we have advocated diagonal debit call options spreads foreseeing both downswings continuation in the near-terms and the major uptrend.

OTC Outlook: The positively skewed IVs of 3m tenors are also indicating both downside and the upside risks.

While bullish neutral risk reversal numbers substantiate this bullish stance, positive RRs are indicating the hedging setup for the upside risks.

The Execution: USDCAD 3m/1w call spread strategy (strikes 1.29/1.32) for a net debit.

The rationale: Firstly, as you could observe the underlying spot of USDCAD has dipped somewhat in the minor trend below 1.30 level with exhausted bullish sentiments from recent past or so, hedgers’ interests remained intact onto the bullish neutral risk reversals in longer tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless, so that the option writer can be rest assured with the initial premiums received.

Secondly, One should understand the prime intricacy of choosing ITM call which is that such options with strike prices close to the price of the underlying spot tend to have the highest risk premium or time-value built into the option prices. This is compared to deep in the money options that have very little risk premium or time-value built into the option price.

Thereby, one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

Favour optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment. Courtesy: Sentrix & Saxo

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios