The Japanese yen has vented higher more recently than that (up 16% vs USD and 25% against GBP in 1H 2016 for example). That’s a reminder that when a currency is as cheap as the yen (USDJPY PPP is at 103 according to the OECD) it can spike pretty sharply. It is kept at current undervalued levels by the commitment of the BoJ to target a 2% inflation rate and anchor bond yields.

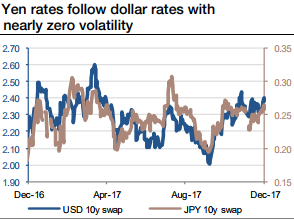

Since the Japanese central bank thrived in killing yen volatility, USDJPY has been a proxy of dollar rates. Japanese long-term rates are following US rates, but have shown almost zero volatility for a year now (refer above graph). USDJPY is thus coincidentally positively correlated with JPY rates.

But for now, majorly what matters most to the FX market next week is how the FOMC members judge the inflation development that is likely to cause volatility in the FX bloc. In the process, the dots, which reflect the individual member’s rate expectations, might be revised slightly to the downside in the long end as many FOMC members have become more doubtful about a sustainable rise in inflation over the past weeks and months. That, in turn, would confirm the market in its view that the Fed will not hike interest rates as often as it is signaling next year and will put pressure on the dollar. A Fed rate hike next week, on the other hand, is almost entirely priced in and is therefore unlikely to have a significant effect on USD.

We see only a small chance of that commitment waning in 2018 because the inflation rate won’t get anywhere near 2%, but the net result is a huge skew in the range of outcomes for the USDJPY.

The base case scenario is another year in a narrow range, with USDJPY 110-118 likely to capture the range for the year.

A break of USDJPY 100 does, however, seem almost inevitable once the BOJ signals a change in policy and is more likely on any time-scale than a sustained move above USDJPY 120.

Waiting for the spark: As long as Japanese rates stay dormant due to the BoJ’s commitment to monetary easing, USDJPY will likely stay driven by its dollar leg and mildly appreciate. But that won’t be the case forever: when the market has the slightest hope that the central bank has finished monetary easing, this will trigger very asymmetric yen risk, i.e. a sudden yen spike, accelerated by the unwind of extreme yen shorts.

Hence, the timing of a potential USDJPY reversal is however very uncertain, prompting us to trade that risk via exotic options.

Buy USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 112.20) A USDJPY 1y put spread strikes 106/103 would cost 0.75%, therefore providing a maximum pay-off of 3.9 times the premium. Setting a global KI at 116 more than halves the price to provide leverage reaching 8.8 at 103 in one year.

Risk profiling: No activation Investors trading a put spread with a global knock-in cannot lose more than the premium initially paid.

However, the structure will be activated only if USDJPY hits the 116 knock-in. Otherwise, it will expire worthless even if USDJPY trades below 106 one year ahead.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices