EUR looks softer despite stronger than anticipated industrial production; sentiment has been neutral to bearish. Market sentiment towards risky assets improved today with major equity markets recovering part of Thursday’s hefty losses. Meanwhile, the 10-yr UST yield was 3bps higher on the day in spite of yesterday’s weaker than expected US inflation data for September. In FX markets, the EURUSD continued its slow recovery and the GBPUSD was consolidating its recent gains on market optimism for an agreement in principle on the issue of the Irish border backstop at next week’s EU Council meeting.

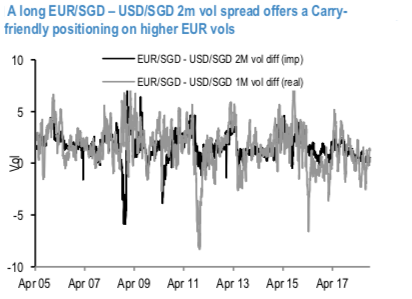

While an opportunity for hedging Italian risk via higher EUR vols can be found on a long EURSGD / short USDSGD Gamma vol RV implementation. The trade offers a direct exposure to higher EUR vols, and, at present, a positive carry (refer 1stchart): the 2M implied spread, at around 0.6 vols, is well below the current realised spread at 1.3 vols.

The common SGD exposure for both long and short vol legs should insulate the trade from another wave of risk-off sentiment for EM and, more specifically, from a resumption of trade tariff tensions between US and China.

In practice, while the sensitivity of USDSGD to global risk factors tends to be higher than for EURSGD, the low- beta/safe haven status of SGD within Asia should contain the magnitude of the moves for both long and short vol legs.

If ever, the opposite sensitivity of USDSGD (positive beta) and EURSGD (negative beta) on the BTP-Bund spread suggests implementing the trade via puts rather than via straddles: in case of a EM risk-off market and/or of a generalised rise in vol levels, USDSGD is expected to rise, thus triggering a sharp drop in the Gamma of the short- vol leg and containing its downside PnL-wise.

The disadvantage of a reduced (or even slightly negative) vol carry due to the relative skews is a feature that we acknowledge but which does alter substantially the benefit of the suggested implementation: 2ndchartclarifies the good historical performance of the trade, especially during episodes of the spread realising.

We propose buying a 2M 25 delta EUR put/SGD [email protected]/6.15 vol indic vs. selling a 2M 25 delta USD put/SGD call @4.6 vol choice spread, spot ref EURSGD 1.5870, USDSGD 1.3802, vega-neutral notionals, to keep delta-hedged. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 62 levels (which is bullish), while hourly USD spot index was at -74 (bearish) while articulating (at 12:26 GMT). For more details on the index, please refer below weblink:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close