Over the last two months, domestic Canadian data has outperformed and, together with intensified Fed cut expectations, has driven USDCAD to the year’s lows. CAD appreciation in G10 against the dollar, having largely shaken off the trade-war flare-up from May and capitalizing on unexpected boosts to 2Q GDP. The recent strength in the data, along with a Fed that looks set to ease at least once in the next two months, require us to mark-to-market lower near-term USDCAD targets, recognizing the potential for some further residual strength in 2H’19 (1.28 at year-end), though we expect some retracement of this firmness in the medium-term (retracing to 1.31 by mid-2020).

Fed is scheduled today for their monetary policy, our base case is for the Fed to cut rates by 25bp, rate markets price in more than one rate cut for the Fed in July. A 25bp rate cut is fully priced in and is still not going to really satisfy anyone. Some market participants are already expecting a 50bp rate cut today and might initially trade the dollar stronger in their disappointment.

The extent and duration of further CAD strength will depend in-part on the durability of recent Canadian macro strength and to what extent BoC follows the Fed in cutting.

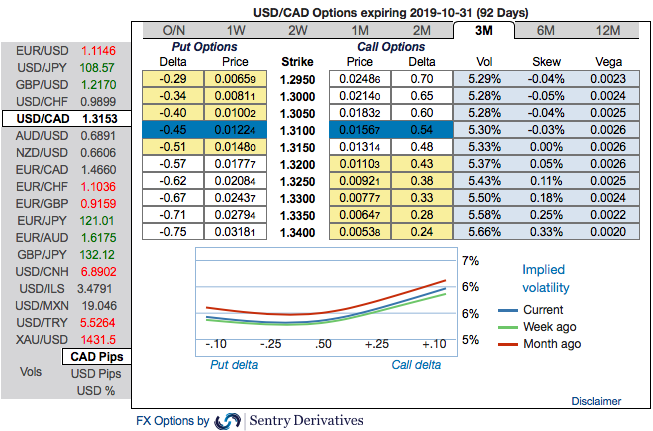

Options Trades Recommendation: At spot reference: 1.3148 level while articulating, on trading and hedging grounds we advocate diagonal debit call options spreads foreseeing both mild downswings in the near-terms and the major uptrend. Positively skewed IVs of 3m tenors are indicating upside risks with OTM bids up to 1.34 level. Bullish neutral risk reversal numbers substantiate this bullish stance coupled with 1m skews that are well-balanced on either side.

Well, contemplating above driving forces and OTC updates, diagonal call spreads as preferred option structures seem the best suitable under prevailing circumstances given elevated skew and favorable cost reduction.

Execute USDCAD 3m/2w call spread strategy (strikes 1.3080/1.33) for a net debit.

The rationale:

Firstly, as you could observe the underlying spot of USDCAD has dipped below 1.32 level with bearish sentiments from the last 1-month or so, hedgers’ interests remained intact onto the bullish neutral risk reversals in longer tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless so that the option writer can be rest assured with the initial premiums received.

Secondly, One should understand the prime intricacy of choosing ITM call which is that such options with strike prices close to the price of the underlying spot tend to have the highest risk premium or time-value built into the option prices. This is compared to deep in the money options that have very little risk premium or time-value built into the option price.

Thereby, one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Maintain the net delta of the position above 70% as shown in the above nutshell and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25% as you could see skews of 2w tenors are well-balanced on either side. Source: Sentrix, & Saxobank

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist