The CAD is trading defensively into the weekend, prior to which it was shining major portion of its 3.17% rally from the late June highs. But CAD weakness is likely to be limited, however, as the CAD remains significantly undervalued relative to our estimated equilibrium based on interest rate differentials and oil prices. We anticipate continued CAD strength into and through next Wednesday’s BoC policy decision and MPR forecast update and look to significant CAD strength on the crosses.

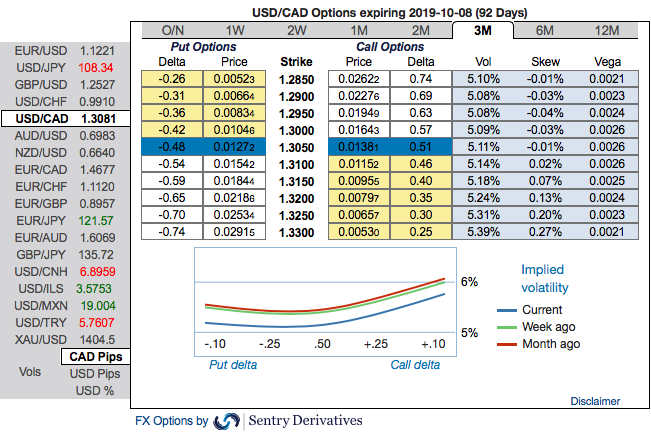

At spot reference: 1.3080 level while articulating, we advocate diagonal debit call options spreads foreseeing both mild downswings in the near-term and the major uptrend. Positively skewed IVs of 3m tenors are indicating upside risks with OTM bids up to 1.33 level. Bullish neutral risk reversal numbers substantiate this bullish stance coupled with 1m skews that are well-balanced on either side.

Well, contemplating above driving forces and OTC updates, diagonal call spreads as preferred option structures seem the best suitable under prevailing circumstances given elevated skew and favorable cost reduction.

Execute USDCAD 3m/2w call spread strategy (strikes 1.3080/1.33) for a net debit.

The rationale:

Firstly, as you could observe the underlying spot of USDCAD has dipped below 1.33 level with bearish sentiments from the last 1-month or so, hedgers’ interests remained intact onto the bullish neutral risk reversals in longer tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless so that the option writer can be rest assured with the initial premiums received.

Secondly, One should understand the prime intricacy of choosing ITM call which is that such options with strike prices close to the price of the underlying spot tend to have the highest risk premium or time-value built into the option prices. This is compared to deep in the money options that have very little risk premium or time-value built into the option price.

Thereby, one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Maintain the net delta of the position above 70% as shown in the above nutshell and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25% as you could see skews of 2w tenors are well-balanced on either side. Source: Sentrix, & Saxobank

Currency Strength Index: FxWirePro's hourly USD spot index was at -25 (mildly bearish), CAD is flashing at -81 (highly bearish), while articulating at (06:50 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align