This week’s report was bullish for crude and bearish for gasoline and distillate. Total commercial crude and refined product stocks drew by 2.5 Mb to 1249.6 Mb. The stockdraw was led by a 5.6 Mb decline in crude oil stocks. At 448.1 Mb, crude oil stocks are at their lowest level since late October 2015, when they were rapidly building.

Much of the remaining excess supply of US crude is at Cushing and in the rest of PADD 2; however, Cushing stocks have declined nearly 9 Mb over the past 4 weeks, as PADD 2 refiners gradually returned from autumn maintenance and as the outage of the 590 kb/d Keystone pipeline reduced supplies in the second half of November. On a 4w av. basis, total refined product demand increased 103 kb/d YoY to 19.66 Mb/d (+0.5%).

Crude prices are edging up higher in early trading sessions today but held near the prior session's three-week’ lows amid concerns over rising production in the U.S.

The conclusion of OPEC’s biannual meeting delivered an agreement to extend the current OPEC-NOPEC deal for a further nine months. This is in line with market expectations and should keep c.1.7 mbd of crude production offline next year, supporting prices at close to $60/bbl in 2018.

No new additions to the consortium of producing nations appear to have been announced although six countries were in attendance as observers, indicating the potential for a further broadening of the current reach of the OPEC-NOPEC agreement, as confirmed by the Saudi Arabian Oil Minister.

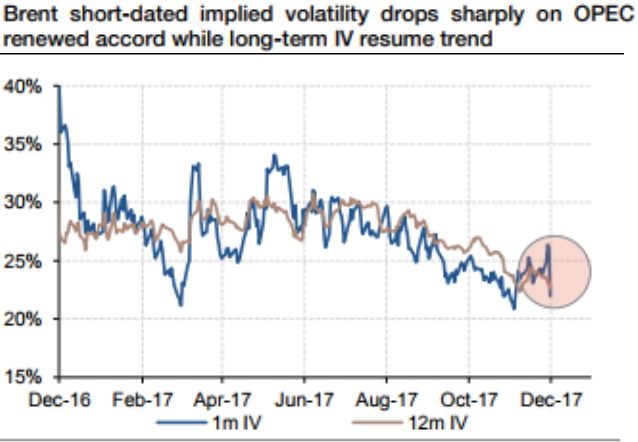

With uncertainty around OPEC’s intentions resolved, short-term implied volatility dropped sharply while longer-term implied volatility continues to trail falling realized volatility. 1-month constant maturity Brent implied volatility fell by nearly four percentage points to below 22%, while 12-month implied volatility was offered at 22.63% (refer above chart).

By way of comparison, 1-month implied volatility was trading some 10 percentage points higher in December 2016.

Going forward, and given OPEC’s apparent commitment to managing oil markets, we expect implied volatilities to continue trending lower, especially on longer-dated options.

Hence, OTM calls and OTM puts of 1m expiries are advocated contemplating above underlying fundamentals.

It has to be executed when the investor is certain that the underlying spot FX would not be very volatile (would neither spike up nor tumble very much).

Upside Potential: Limited to the two premiums received and would be realized when the underlying spot FX at expiry is exactly at the strike price level.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data