It is difficult, if not impossible, to handicap the extent to which the escalation of tariff risks has already been discounted into battered EM asset prices; what can be said with more assurance is that a handful of assets that screen as fair or expensive vs the global growth cycles have not factored in a more disruptive, contagious phase of the trade war.

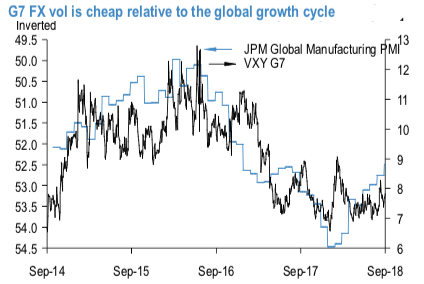

G7 FX volatility is one such cheap asset. VXY G7 is priced about 1 % pt. too low for the current level of Global manufacturing PMI, a 1 std. error mismatch (refer 1stchart).

In contrast, VXY EM screens 3.5% pts. too high (+3.1 std. error) on similar metrics, highlighting the EM/DM vol gap that has opened up in the past few months. EUR and JPY are the two largest components of the VXY G7 basket and also the two biggest contributors to this cyclical cheapness.

We have already discussed EUR vol / options in the context of Italian budget risks in recent publications (e.g. Option plays for CNY basket calm and Italy risks), the gist of which is that owning EUR puts/USD calls in various formats (6M 10D puts and/or EUR vs. gold 6M 25D put switch) is appealing given the combined low vol, flat curve and positive forward points.

It is generally expected that the ECB will announce the end of the asset purchasing programme by year-end. The market has been comprehensively prepared for that so that the decision in itself is not a reason for EUR strength.

European growth has generally improved, the industrial sector has struggled. Eurozone industrial production fell in both Q1 and Q2 and the reported declines in German and Spanish output point to further slippage in July.

While Euro vol is more sensitive to the abate and flow of Italy headlines, JPY is more levered to contagion from an escalation of trade tensions.

Even absent these risks, there are good reasons for directional yen ownership – structural under-valuation, susceptibility to hawkish BoJ policy tweaks, political imperative for lower USDJPY amid US – Japan trade negotiations and the unwind potential of retail Japanese EM investments – that can push USDJPY towards 107 by year-end.

The combination of low vol and elevated risk-reversal/ATM ratio means that USD put/JPY call spreads/digitals are inexpensively priced near 4-yr lows (refer 2ndchart).

We recommend: Off spot ref. 111.50, buy 3M 107 strike USD put/JPY call at-expiry digitals @ 14.75%/15.75% USD indic. Digital / spread structures, as opposed to outright USD puts, are in deference to reasonably high risk-reversals, the ongoing softness in realized vol, and the persistent nature of Japanese outflows this year that have dampened yen’s traditional risk beta.

This has coincided with a period of S&P 500 strength but can turn if the latter were to come under pressure after the new round of trade sanctions.

FxWirePro’s Currency Strength Index: Hourly USD spot index is flashing 101 (which is bullish), while hourly EUR spot index was at shy above -36 (bearish) at 11:18 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate