Why doesn’t PBoC fix a neutral USDCNY rate? It is comprehensible that the PBoC intended to guide its currency stronger when everyone expected to see a rapid CNY depreciation, which was the idea behind the “counter-cyclical factor”. However, although the market has become much more neutral on its yuan outlook now, the USDCNY fixing still tends to surprise on the downside, which happened this morning again.

Hedging the “red line”: Logical hedge to North Korea is long USDKRW or long JPYKRW, but won options are pricey. China is unlikely to be safe haven asset.

Hedging extended price action: CNH would weaken alongside a correction in the EUR (positioning elevated, expensive vs real rate differentials).

Hedging a growth slowdown: An earlier or larger Chinese growth slowdown could alter current bullish positioning.

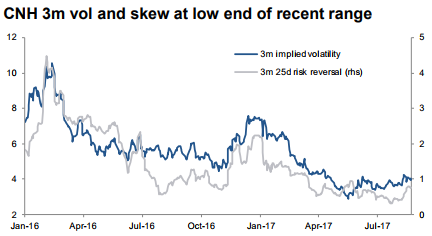

Vol parameters: Current parameters (skew and convexity) are generally conducive to owning volatility and positioning for the possibility that the recent strength is partially reversed.

Hence, we advocate buying USDCNH 3m call strike 6.83. Entry level (date): 0.41%, spot ref: 6.69 (May 18 2017) Maximum loss limited to premium paid.

USDCNH and implied vol is marginally below our entry level; use as a hedge against North Korea risks, EUR correction, and for portfolios that are short dollars and long carry such as our own.

Risks & what to watch for:

USD dynamics and leadership changes: Capital outflows are minimal, so CNH might need to adjust alongside a broader dollar move. Also, there is a risk that the authorities promote FX strength ahead of the leadership changes in late October.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate