The full unwind of the post-election Trump trade, which has led to a weaker US dollar and lower US Treasury yields, has supported gold’s relatively strong performance this year.

To reflect a more benign inflation outlook and reduced likelihood of fiscal stimulus, our rates strategists have lowered their interest rate forecast for the balance of the year.

We remain tactically short gold into the FOMC meeting on June 14. However, considering that long-term yields have declined and inflation expectations have weakened there is a risk that the Fed might deliver another ‘dovish hike’ similar to one in March, which would be constructive for gold.

Beyond our short-term tactical recommendation, our broader view on gold is that prices will remain largely range-bound with an upward trajectory throughout the year. We increase our 3Q and 4Q prices by 3-4% and now see gold averaging $1,240/oz in 2H17.

Bearish Scenarios:

a) Fed raises rates faster and more aggressively than expected;

b) The dollar significantly strengthens from current levels;

c) ECB and BoJ take definitive steps away from accommodative monetary policy;

d) Asian physical buying is weak even during seasonally strong periods;

e) The central banks actually begin selling gold on net.

Bullish scenarios:

a) Fed sends dovish signals throughout 2017, weakening the dollar;

b) The central banks around the world move deeper towards negative rates;

c) EM economic worries spread and global recessionary risks rise;

d) The sharp pickup in Asian physical buying.

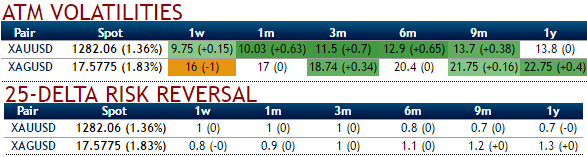

OTC outlook and option Strategy: Buy XAUUSD 2w ATM straddle

Please be noted that the OTC markets for this precious metal have been indicating the bullish neutral hedging sentiments, while implied volatilities have been spiking higher ahead of Fed’s hiking hopes.

Although we could see some sort of bullish sensation, the prevailing trend has been range bounded with the major trend goes in the consolidation phase, the recommendation goes this way:

Initiate long in 6m ATM +0.51 delta call, and simultaneously buy ATM -0.49 delta put of the same tenor for net debit.

Well, this options trading strategy that is used when the options trader ponders that the underlying gold prices would experience significant volatility but not sure of the direction of the swings.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum

Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell