Long gamma in precious metals: Two weeks ago our fundamentals analysts flipped bullish precious metals and now expect Gold to extend the bounce by about 2-3% by the end of Q2 and Silver to catch up on the move with a forceful 11% rally in 2Q.

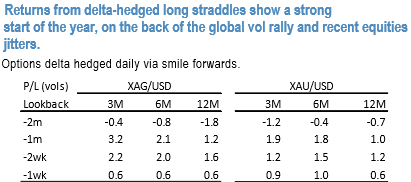

Both Silver and Gold have shown a solid P/L over the last few weeks (refer above table). With XAG gamma lagging the recent rally, realized vols being firm and spot having plenty of room XAGUSD strikes us as a solid defensive, long gamma vehicle.

Gold skews should stay well supported and have room to widen striking 3M delta-hedged 25 delta riskies as a good value, positive vol carry risk off hedge.

One interesting risk-off RV set-up - in line with the long Silver gamma that has emerged on the back of the recent market dislocation - is long Silver (or Gold) puts vs. short AUD puts(both legs delta-hedged). A 3-sigma move over the past two weeks has taken 1M 25D AUD riskies to their widest in 6-months.

Anecdotal reports peg the demand for AUD skew to be stemming hedging demand for short variance swaps on dealer books initiated earlier in the year. It is impossible to benchmark how far the short covering process might have yet to run, but the fact that AUD riskies stalled last week even as cross-yen vols and skews were blowing out suggests that a good part of the move may be behind us.

As we have flagged on a number of occasions and as many vol investors are well aware, owning AUDUSD skews (delta-hedged) has been one of the most reliable money losers in the post-GFC years since the reduction of RBA cash rates to all-time lows has decimated the erstwhile speculative carry positioning base in the currency and rendered it a pale shadow of its former high-beta self, with the result that the much more modest (inverse) spot-vol correlation these days during market disruptions no longer justifies a hefty premium for AUD puts over AUD calls.

Hence this abrupt widening of AUD skews strikes us as an opportunity to sell OTM AUD puts to finance longs gamma in precious metals. Exhibit2 shows that XAG-AUD vol spread is located at multi-year lows, an artifact not only of the recent spike in AUD vols and skews, but also still depressed Silver vols. Thanks to Silver’s much higher risk beta, a sliver vs. AUD vol spread has a reliable track record of widening appreciably in stress, and at current levels carries little / no realized vol penalty for being long. Courtesy: JPM

We recommend Buy 3M XAGUSD @ 18.6 /19.25vol vs sell AUDUSD @9.9vol indic 25 delta puts, in vega neutral notionals

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One