The lifelessness of FX vols this year in the face of stock market jitters and rise in interest rate volatility has surprised many including us, but at least some allowance can be made there for the unpredictability of contagion channels that transfer volatility from one asset to another.

One pocket of the FX vol market where it is difficult to offer even that token excuse because of the direct impact of interest rate volatility on options pricing is long-dated yen vol.

Regular readers will recall that we have been bullish long-end yen volatility for a good few months as a low bleed, good value all-weather portfolio hedge since 4Q’17, without any success so far it has to be admitted. USDJPY 5Y ATM vol is now nearly unchanged on the year after subsiding from its VIX shock highs, which does not sound like an acutely disappointing outcome till one granularly examines the mathematical building blocks of longer-dated FX vol: short-dated USDJPY vol as measured by 3M ATMs is up 0.3 % pts. YTD, an equally weighted blend of 1Y4Y, 2Y3Y, 3Y2Y and 4Y1Y US swaption vol is +10abp on the year, the corresponding Yen swaption vol is -2 abp and 3m realized correlation between USDJPY spot and (US-Japan) 5Y swap rate differential –the most crucial building block of long-dated vol pricing –has fallen a mammoth 30%-50% pts since the turn of the year.

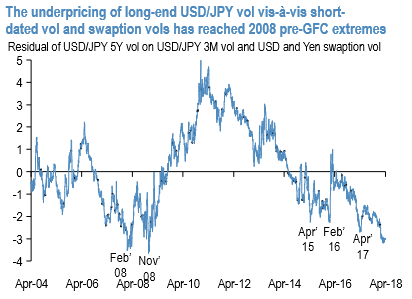

The tiny drop in yen swaption vol aside, every single piece of the option pricing puzzle suggests long-end vols should have crept higher this year; that they have not leaves them screening as cheap relative to contemporaneous drivers as at their extreme in early 2008(3 vol pts. below model fair value – (refer 1st chart).

After the painful purge of vega longs towards the end of last year, we were cautious about further vol depressing flows coming online from Japanese importer hedging, which typically tend to cluster around March and April around the new Japanese fiscal year (refer 2nd chart). The bulk of the vol compression should now be behind us judging from this seasonal pattern, though the flow-driven cap on vol may remain in place through the end of the month if history is any guide. A leak lower in 5Y ATMs towards 9.0 or below from here should serve as decent entry points into strategic longs. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has shown 50 (which is bullish), while hourly JPY spot index was at -83 (bearish) while articulating at 13:27 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?