In this write-up, we emphasize on staying short in USDCHF spot trades and short EURCHF put options. USDCHF turned elegantly lower towards the end of the week when the dollar lost ground against other reserve currencies in the lead-up to and the aftermath of the Section 301 investigation announcement.

The FX market seems to be gripped by springtime lethargy. Even though there are some plausible moves, such as a weaker euro following some cautious comments by ECB officials or the dollar easing slightly in reaction to disappointing US consumer confidence yesterday afternoon.

What drives the above-stated trades: Well, we maintain to uphold USDCHF shorts as a core long Europe position that has added cushion from resilience to trade-related jitters in equity markets and stealth tapering of the SNB balance sheet.

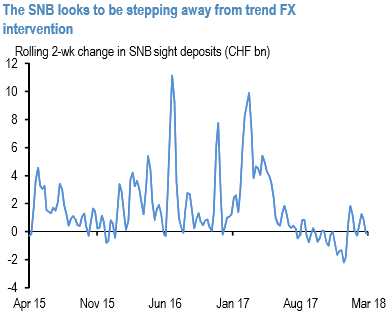

On the latter, SNB sight deposits have now declined CHF 4bn or 1% from their peak last August, and the SNB does seem to be stepping aside from trend FX intervention (refer 1st chart).

Cash CHF longs aside, the short-dated EUR put/CHF call we wish to sell with an intention of a part of a covered EURCHF short package to expire worthless and enable us to lock in the entire premium credit as the underlying spot FX likely to prolong its bullish travel.

Never forget to pick up tepid IVs (refer above nutshell evidencing for EURCHF ATM IVs, the least among G10 FX universe) in the slow pace of CHF appreciation over the past few months could have been more effectively monetized through covered option selling structures of this kind, or even better through USD put/CHF call spreads (refer 2nd chart).

The outperformance of out-of-the-money CHF call selling constructs is in part due to the market's long memory of the franc de-peg that keeps those options priced above historic norms and helps defray the material negative carry on cash positions.

We’ve already advocated shorts in USDCHF spot trade, we like to maintain the position with a strict stop at 0.9585. Marked at -1.45%.

Short a 1m 1.1775 (ATM strike) EURCHF put, received 29bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -30 levels (bearish), while hourly USD spot index was at 67 (bullish), CHF at -133 (bearish) while articulating (at 12:36 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns