RBNZ Monetary Policy Statement will be important in setting the tone for 2019. Unlike the Fed, and RBA, which had a hiking bias they could jettison, the RBNZ doesn't really have a tightening bias to unwind. NZD crosses have been weaker, we could foresee NZDUSD at 0.63 levels by H1’2019.

The Governor has already been stating that “the timing and direction of any future OCR move remain data dependent”, and has made little reference to the eventual rate hikes laid out in the staff’s projections. This may make it difficult to match the degree of volte-face executed by other central banks of late, though it seems likely the Governor will try to meet the market by emphasizing global downside risks.

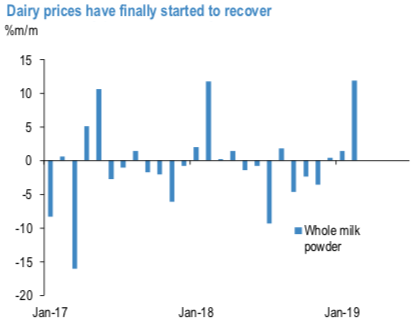

Looking beyond rate differentials, local catalysts for NZD are mixed. This week’s labor market data saw unemployment move back up to 4.3%. However, this comes after 3Q’s stunning drop to a 10-year low, so unemployment is still a touch below where it was six months ago, and probably 1%-pt below NAIRU. Dairy volumes are growing more strongly than they have for some time after prior supply disruptions. Dairy prices have rallied in recent auctions, though posted a similar seasonal pattern last year which was not sustained (refer 1stchart).

In contrast to Australia, where the export-relevant commodity markets are tight, prices are high, and large exporters have seen large profit gains, New Zealand’s exporters are starting any tentative recovery in China demand from a place of weakness (refer 2ndchart). The fall in oil prices will likely offer some reprieve to trade outcomes, but exports are unlikely to benefit from any stabilization in China’s GDP growth that is geared toward fixed asset investment. A shift to stronger consumption outcomes in China would be more positive, however, so the administration’s focus on tax cuts could prove supportive.

The RBNZ (the sole banking regulator in NZ) has slightly extended its consultation period for the Bank Capital Review. The Governor announced in December an effective doubling of tier one capital requirements, well beyond analyst expectations.

Amid all the above aspects, please be noted that FX options hedging activity of this pair is also in sync with the above projections. 6m IV skews have clearly been indicating bearish risks. Hence, major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

These positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.63 levels (refer above nutshells evidencing IV skews). Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 29 levels (which is mildly bullish), while hourly USD spot index was at 27 (mildly bullish) while articulating (at 11:22 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action