The European Central Bank (ECB) is scheduled for the monetary policy on July 25th. ECB’s readiness to cut its key rate next week. And there is no reason for the euro to appreciate considerably in the short run.

The currency differentiation and short correlation were laid out as one of the core vol alpha themes for H2 in the Mid-Year Outlook. One class of trades that were identified in there was selling GBP vs. commodity FX correlation on the view that GBP’s idiosyncratic political dynamics would lead to low / no correlation with other cyclically sensitive FX.

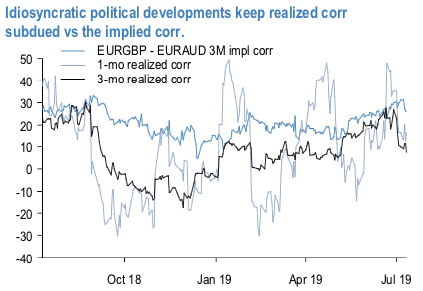

One such corr short that could be considered at current levels is EURGBP vs EURAUD: 3M implied corr is 26% vs. 2-wk realized corr -4%, 1-mo 16% and 3-mo 7% (refer 1stchart). The backtest in chart 2 shows favorable historical performance over the past 3-yrs since the Brexit vote.

A pushback is that if the ECB pivots towards re-starting QE later this year the EUR could fall against everything in sight and lift all EUR-x vs EUR-y realized correlations, as it happened when EURUSD fell from 1.40 to 1.05 during the ECB QE of 2014-16.

Two ways of guarding against this:

a) The limit expiry to pre-September ECB, when a 10bp rate cut is expected and when a potential QE announcement might come; and/or

b) Hold appropriately sized EURUSD put spreads against a short corr. swap, but sizing is a non-trivial problem.

With 2M EURGBP – EURAUD corr swap @24/35 indic we think vol spread is an attractive alternative to consider: 2M GBPAUD – EURGBP vol spread @0.95/1.45 indicative. Courtesy: JPM

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons