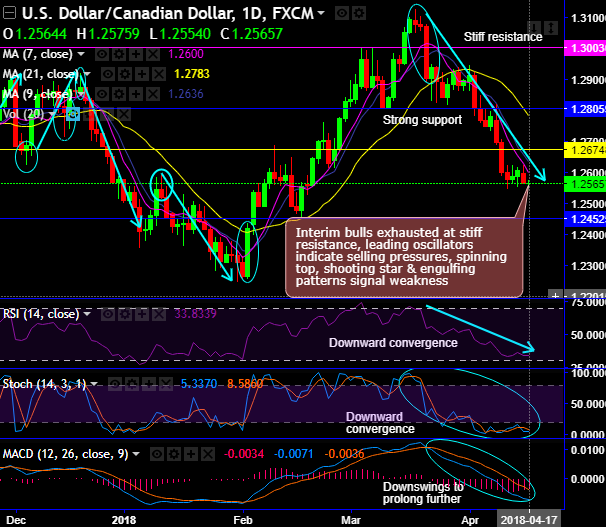

As you could watch USDCAD technical chart on daily plotting, the minor trend of this pair has been absolutely bearish bias ever since the occurrence of spinning top, shooting star and bearish engulfing patterns (refer oval shaped area on daily plotting).

Every attempt of bull swings is restrained below 7DMAs. Both trend indicators (DMA and MACD) show bearish crossovers that indicate the extension of downswings. While both leading oscillators (RSI and stochastic curves) show downward convergence to indicate intensified selling momentum. The occurrence of spinning top, shooting star and engulfing patterns signal weakness.

While the major trend slides below 38.2% Fibonacci levels, shooting star signals weakness, both leading oscillators on this timeframe have been indecisive but bearish bias (weekly terms).

The back and forth in the NAFTA renegotiations has been the major driving forces of CAD exchange rates in recent months. The negotiating parties recently signaled that an agreement is possible. The BoC had identified uncertainty about the direction of the NAFTA negotiations as an important factor of uncertainty that had clouded the outlook - and thus also the probability of further interest rate hikes in the near future. The risk for that has declined which increases the likelihood of the Bank of Canada's continuing its rate hiking cycle, which supports CAD.

Contemplating above shot term technical rationale, at spot reference: 1.2570, you can place trades to construct tunnel binary options spreads using upper strikes at 1.2578 and lower strikes at 1.2530 levels, these leveraged instruments are likely to fetch magnified effects in payoff structure as long as underlying spot FX keeps dipping but remains above lower strikes.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -5 (which is neutral), while hourly CAD spot index was at 12 (neutral) while articulating at 10:06 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  EUR/JPY Stuck in Neutral Gear — Bulls Still in Control Above 182

EUR/JPY Stuck in Neutral Gear — Bulls Still in Control Above 182  EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm

EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  FxWirePro: EUR/AUD downside pressure builds, key support level in focus

FxWirePro: EUR/AUD downside pressure builds, key support level in focus  CAD/JPY Dips After Weak GDP – Buy the Pullback at 113, Eyes 115 Breakout

CAD/JPY Dips After Weak GDP – Buy the Pullback at 113, Eyes 115 Breakout  AUDJPY Bounces Back: Strategic Buy at 107 Targets 110

AUDJPY Bounces Back: Strategic Buy at 107 Targets 110  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  FxWirePro: USD/ZAR recovers slightly but bears are not done yet

FxWirePro: USD/ZAR recovers slightly but bears are not done yet  FxWirePro: GBP/AUD gains some upside momentum but still bearish

FxWirePro: GBP/AUD gains some upside momentum but still bearish