In a context of low yields, depressed volatility and range-bound markets, double-no-touch (DNT) options provide an appealing alternative to the FX carry trade. The current global macro environment is characterized by weak economic volatility. One of the consequences is that FX volatility has been depressed during most of 2H’17.

Sustained growth but still-soft inflation dynamics are ensuring that monetary policy normalization is a slow process so far, with limited risk of acceleration by central banks.

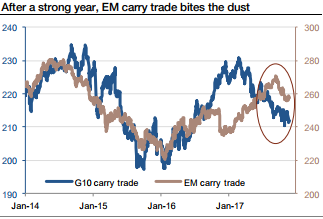

Frustratingly, the low FX volatility isn’t supporting carry trades given the depressed yields. The G10 carry trade has suffered throughout 2017, and after a strong start, EM carry is also biting the dust (refer above graph).

Also, currencies are not exhibiting strong trends that could favour momentum trading. In this context, investors are still struggling to generate returns.

EUR-cross-risk-reversals have understandably re-priced sharply in the direction of EUR calls, especially against G10 commodity currencies that were among the worst performers of the week.

We struggle to see severe dislocations in this space at current levels, with some mild value only in EURCAD 3M riskies at 0.4 which we are not inclined to chase in light of the cheapness of the loonie on short-term models and the potential for an oil rebound in coming weeks that can cap the extent of EURCAD strength. EURCNH riskies (3M 25D -0.05) however strike us as interesting buys.

First, EURRMB has a long history of high correlation to EURUSD which has been formalized since late 2015 by virtue of China’s migration to basket FX mechanism that assigns a significant (16.3%) weight to the common currency; hence EURCNH is a bonafide proxy for expressing a core bullish Euro view.

Second, it offers exposure to CNY disorder without charging a vol premium, making it an excellent hedge against USDCNH carry trades that have been instituted lately in anticipation of an oriental summer snooze fest.

Delta-hedged EURCNH risk-reversals also offer substantial positive carry (options are net costless, the short EURCNH forward delta-hedge is carry positive; refer above chart), hence qualify as standalone bleed friendly risk hedges in vol portfolios.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis