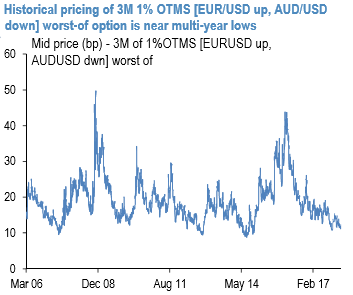

In order to take advantage of vol/correlation setup, one could play directionally stronger reserve currency vs. weaker high beta (vs. the USD) via worst-of options. Rich correlations and still generally depressed vols (especially in EUR crosses) map into the favorable pricing of worst-of options for EURUSD vs. AUDUSD that are priced near the multi-year lows in premium (refer 1st chart).

Moreover, even absent trade skirmishes, the anticipated direction of the two currencies is in line with our analysts’ view of EUR outperformance this year as ECB moves towards policy normalization and Antipodean central banks staying on hold in the face of structural headwinds.

Long vega hedge via cheap FVA spreads: 1x2 forward volatility (FVA) spreads utilize favorable vol slide along term structures and are passage-of-time friendly, low maintenance long vega positions.

The basic construct involves selling a shorter dated FVA along the upward sloping segment of the vol curve to partially fund the purchase of a longer dated FVA along a flatter part of the term structure.

The roll-down of the short leg compensates (or even eliminates) the slide of the long position while preserving the overall net long vol exposure of the structure.

Historically P/L on this type of structures closely coincided with bounces in the spread pricing (refer 2nd chart).

In the case of EUR/Antipodean crosses, current entry levels near pre-GFC lows are a bargain by historical standards (refer 3rd chart), while the net 6 months static vol slide at forward start of the short leg is substantially positive (+1vol), making the long/short structure superior to holding a similar expiry straddle. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?