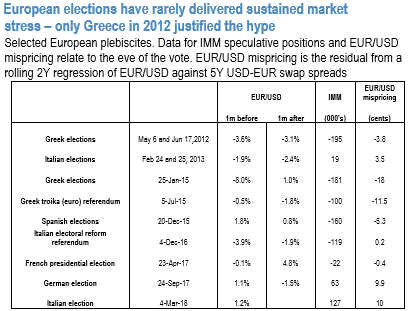

At first blush, the currency market’s disinterest in the Italian election creates both incentive and opportunity to hedge the tail-risk of a non-mainstream government (refer above charts). After all, the euro is now overshooting interest rate models by the same margin it undershot in the early stages of QE prior to the Greek referendum on the troika bail-out in mid-2015, an average of 10% against USD and JPY.

In addition, the IMM measure of speculative positioning intimates that EUR longs are now two-thirds as large as the shorts at the peak of the region’s debt crisis when Greece went to the polls in 2012.

But while valuation and positioning will increase the sensitivity of EUR to a market negative outcome from the election, this asymmetry is not sufficient reason to advocate holding indiscriminate or broad-based EUR cash shorts as a hedge.

Such positions would run counter to our assessment of the fundamental trend, which we believe is still to a higher EUR predicated on the normalization underway in the economy and monetary policy and a reversal of the distortions to capital flows caused by ECB QE and negative rates.

Moreover, it is not clear to us that the damage to EUR from a non-mainstream government would be so severe to warrant hedging an event whose subjective probability we assign at less than 5%. After all, European elections rarely lived up to the hyperbole even during the debt crisis –only the Greek elections in 2012 caused EURUSD to drop by more than 3% over the following month –and the non-reaction to Germany’s recent inconclusive election demonstrates that political instability doesn’t automatically beget currency stress. Politics came to prominence as a threat to the EUR at a time of economic crisis, whereas now a vigorous cyclical recovery is serving to assuage anti-EUR populist sentiment and further curtail the risk of an intentional EUR exit (the ECB already neutralized the risk of an unintentional exit caused by untrammeled financial market contagion).

In FX options we highlight zero-cost conditional hedges (EURGBP vs EURCHF put switches); long gamma positions in EURAUD and EURNZD; 1Mx1M fwd vol in EURAUD and EURNZD. EUR bulls can exploit a highly inverted curve to gain cheap topside exposure through selling front-end vs. back-end EUR calls, for instance, short 3w EURJPY calls vs long 2m EURJPY calls. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index has turned into -45 (which is bearish ahead of manufacturing PMIs, unemployment rate, 10Y bond auction in Eurozone for today, and German retail sales data prints for tomorrow) while articulating (at 10:52 GMT).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise