The EUR remains subdued due to Italian budget risks. Meanwhile, today’s ECB minutes will be scrutinised for clarity regarding the additional comment in their post meeting statement which referred to the risks to the economy from protectionism and emerging markets.

We look for options constructs for hedging EUR weakness in case where Italian yields were to rise further. We like considering maturities of around 2M for allowing for the budget to be officially released by the government, voted by the Italian parliament and later reviewed by the EU, in a back and forth process which could extend until the end of November. The fact that EUR vols reacted just modestly to the announcement of the Italian budget makes the entry point of the trade attractive, in our view.

One can further look to cheapen a long vol structure by introducing a correlation element to it. In refer 1st chart, we consider the time series of pair-wise implied EUR- correlations of CHF, JPY and USD. Current levels of 2M implied correlations don’t stand as dramatically undervalued (at 58% on average), but haven’t spiked on the Italian budget news either. By considering a set of triplets of EUR-crosses in the G7 space, we would find that in a worst-of put structure, JPY, CHF and USD would be the one offering the least correlation discount (60%) vs the cheapest plain vanillas.

By choosing the CHF, SEK, USD triplet, for instance, the correlation discount could rise to 80%, but the sensitivity to the BTP-Bund spread would typically find EUR to appreciate vs SEK on a higher level of spread, thus making the latter currency less suitable to be included in a EUR hedge trade.

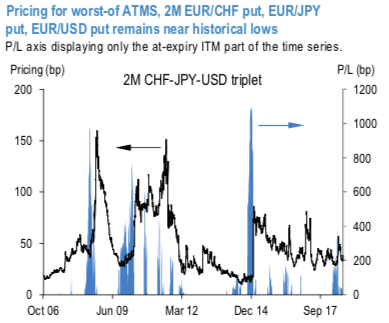

The pricing of the structure remains competitive from a historical perspective (refer 2nd chart, with the trade often delivering large PnL on the back of jumps in vols and/or correlations (with max leverage >10 times).

We opt for 2% OTMS strikes for further cheapening the premium and structuring it as a proper tail-risk hedge. We consider 2M, 2% OTMS worst-of EURJPY put, EURCHF put, EURUSD put at 14/18.5 bps.

Alternatively, one could consider an implementation via dual-digitals involving just two EUR-crosses. Amongst the most sensitive EUR-crosses against the Italian yields, EURCHF lower EURUSD lower is the combination offering the highest maximum leverage (around 9 times). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 79 levels (which is bullish), while hourly USD spot index was at -105 (bearish) while articulating at (11:06 GMT). For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields