US West Texas Intermediate crude goes up 66 cents at $57.80 a barrel while articulating ahead of EIA’s inventory check today.

The largest UK oil pipeline system, the Forties pipeline, was shut down on Monday to undergo emergency repairs. This disrupted over 400 kb/d of flows planned for December.

Front-month ICE Brent crude prices surged from $63 late Friday/early Monday to nearly $66 early Tuesday, before falling back to $64. While the Forties shutdown has provided a price floor, flat price gains quickly evaporated in a global market that is still oversupplied and with output rising in the United States.

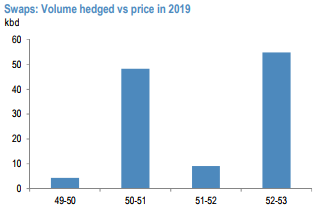

As we enter 2018, this equation should change as producers use swaps for the rest of the year. In terms of pricing, there were more volumes hedged between $49-52/bbl WTI, Exhibit 8, followed by slightly lower volumes hedged between $52-55/bbl. Limited volumes were hedged around $55-57/bbl levels.

This clearly is interesting to note as producers were very comfortable around the lower 50’s to hedge. For 2019, producers hedged mostly in the lower 50’s range once again (refer above diagram).

Additionally given the volumes hedged is significantly lower in 2019, producers would rather wait and watch and layer in when oil prices get supported intermittently. There is also a trend of smaller producers hedging at slightly lower price levels than the large caps for both 2018 and 2019 but that is still a marginal difference.

However despite higher hedges in place which might pose risk to oil markets as US producers are typically expected to add more oil on the back of hedged volumes, can they and will they add the extra barrels significantly on top of the hedged barrels which are not typically hedged? We take a look at both upside and downside risks to US upstream production.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation