The intermediate trend of gold has been stuck in the tight range between $1,361 and $1,306 levels. The hammer and bullish engulfing patterns have occurred in between these ranges to intensify rallies (on daily terms).

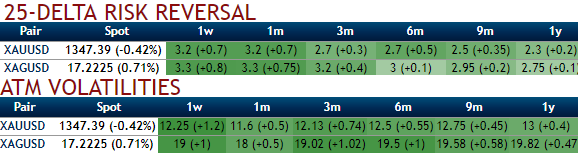

Please glance through positively skewed IVs of 3m tenors are bidding for OTM call strikes at 1410 levels, this bullish risk sentiment is substantiated by mounting positive risk reversal numbers.

The option pricing of OTM call and OTM put that seem to be exorbitantly priced-in. 1w (0.5%) OTM calls are trading at 85% more than NPV, whereas the IVs of these tenors are trending just shy above 12.25%. Hence, one can easily spot out the disparity between IVs and option pricing.

Well, on speculative basis, writing expensive calls and puts are recommended to establish short strangle strategy that are the best suitable amid prevailing lower IV condition of XAUUSD, hence, the strategy reads this way, shorting 1W (1%) OTM puts as well as 1W (1%) OTM calls for a net credit.

The strategy not only gives you the advantage of an anticipated volatility crush but also give us some room to be wrong because we may short premium narrowing strikes while in greed of collecting more credit than when IV is low.

On hedging grounds, stay long in CME gold contracts for Dec’18 delivery, with our FX team pulling forward their bearish USD view, we now believe the persistence of USD weakness is here to stay. As such, we recently boosted our gold price forecasts and recommended length in Dec’18 CME gold. We saw the early March pullback as an advantageous level to add length and lower our average entry cost.

We kept reiterating longs in gold at $1,352.80/oz for Dec’18 delivery. Added an equivalent unit at $1,327/oz on April 1st week as well, 2018 with a new entry level. Trade target is $1,540/oz with a stop at $1,273/oz.

Stay long Dec’18 CME silver: On the back of upward revisions on gold, we have further boosted our silver forecasts and, amidst a broader medium-term precious metals rally, see the potential for silver to outperform gold as the XAU/XAG ratio moves lower towards 70 over the second half of the year.

On the fundamental side, silver’s linkage to industrial demand makes it more exposed to a late-cycle demand thrust, which should also boost its pricing prospects, if anything. As such, we look for silver to break out higher over the medium-term. Given a strong technical outlook in early March, we decided to add to our position to lower the average entry cost.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential