The dollar relinquished gains after the Fed left rates on hold and failed to provide any clues for the timing of the next rate increase.

But the center of FOMC lining up closer to Lacker, hawks for December.

FOMC highlights ‘improved’ business and consumer sentiment.

The FxWirePro currency strength index for the dollar was little changed, relinquishing its first gain for the week after gaining as much as 0.3% on stronger-than-expected ADP jobs and ISM manufacturing data.

The greenback appeared to be trying to find equilibrium amid muted and erratic foreign exchange flows that pushed the euro initially to a fresh low at 1.0756 while USDJPY fell back to below 113.013 after the Fed announcement.

The advance US GDP for Q4 was on the weaker side of expectations although most of the miss was attributable to net exports - they subtracted a chunky 1.7ppts from growth.

Even USD/JPY 1w vols are at the low range of expiries covering a BoJ meeting. Thus the vol softening looks more like temporary setback than a full-fledged vol cleanout, where there remain unresolved issues for global growth (how much growth will Trump's program actually deliver, how does an equity bull run reconcile with a Fed tightening cycle) and the spectrum of a tail-risk sell-off continues to loom over bond markets.

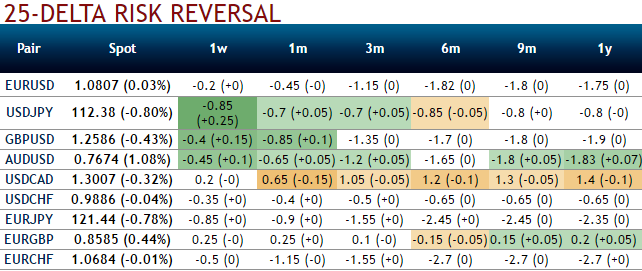

Amid all these developments OTC functionality for the dollar has been intensified. Please be noted that the IVs of dollar crosses are spiking of across various tenors, while delta risk reversals also indicate a shift in hedging sentiments that shows offloading in heavy downside risks.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady