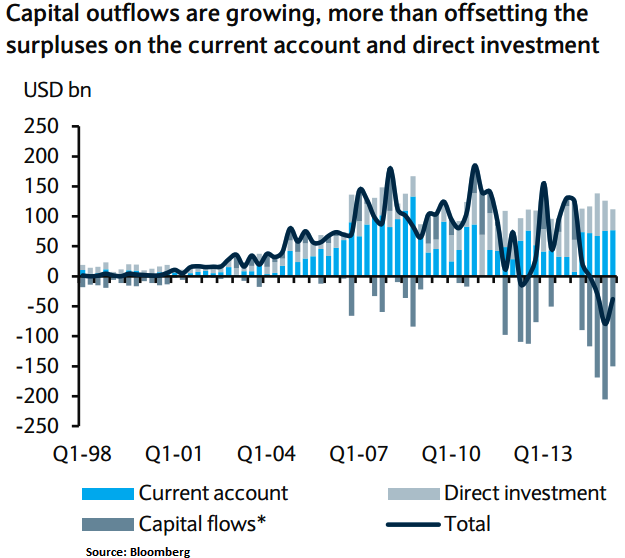

Although China's capital account is closed, several illicit channels of capital outflows have made the capital account rather leaky. Leaky capital account estimates outflows and policy implications, the capital outflows from China could rise from the current 8-10% of GDP, driven by slowing growth, financial market volatility, policy uncertainty and currency overvaluation. In an adverse scenario, total outflows on the capital account could rise to a significant - 15% of GDP. Since these outflows are much larger than current account inflows of 5% of GDP, they will pressure China's FX reserves and/or the CNY exchange rate.

The valuation models from Barclays, it suggests that the CNY is about 5-10% overvalued and with China's growth prospects deteriorating, if China absorbs the balance of these outflows (USD1trn) completely by selling reserves and meeting hedging demand (in forward markets), this implies a drawdown of 28% of the current reserve portfolio. We believe this is a significant amount, especially if authorities are unable to slow capital outflows. We expect a weaker CNY over the medium term and significant jump risk for USDCNY as sustained intervention of such a size is unlikely given the uncertainty of success.

We see risks of capital outflows and CNY depreciation pressure persisting. We think a 10% fall in the CNY versus the USD is needed to stabilize the REER and capital outflows. It is recommended a long USDCNH 6-month forward trade and maintain our USDCNH call spread.

Forecasts (USD/CNY)

Spot - 6.37, Q4'15 - 6.80, Q1'16 - 6.90, Q2'16 - 6.95, Q3'16 - 7.00

Outright Forward

Q4'15 - 5.4%, Q1'16 - 6.0%, Q2'16 - 6.2%, Q3'15 - 6.3%.

FxWirePro: Extended impact of CNY on capital outflow – USD/CNY trade strategies

Tuesday, September 22, 2015 12:13 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: NZD/USD pulls back from 6-month high

FxWirePro: NZD/USD pulls back from 6-month high  NZDJPY Poised to Break Higher: Buy-the-Dip Strategy Above 91.40 Support

NZDJPY Poised to Break Higher: Buy-the-Dip Strategy Above 91.40 Support  FxWirePro: USD/CAD claws back some ground, but downtrend remains intact

FxWirePro: USD/CAD claws back some ground, but downtrend remains intact  FxWirePro: USD/ZAR gains mild momentum, trend remains bearish

FxWirePro: USD/ZAR gains mild momentum, trend remains bearish  EUR/GBP Slumps to 0.86598 — Bears Dominate While 0.86750 Caps Any Bounce

EUR/GBP Slumps to 0.86598 — Bears Dominate While 0.86750 Caps Any Bounce  GBPJPY Bulls Stay in Charge: Holding 210 Unlocks 214+ Upside – Buy the Dip

GBPJPY Bulls Stay in Charge: Holding 210 Unlocks 214+ Upside – Buy the Dip  FxWirePro: GBP/NZD maintains bearish bias with focus on 2.2650 level

FxWirePro: GBP/NZD maintains bearish bias with focus on 2.2650 level  EURJPY Trapped in Bearish Squeeze: Sell Rallies Near 184 – 180 in Sight

EURJPY Trapped in Bearish Squeeze: Sell Rallies Near 184 – 180 in Sight  FxWirePro: EUR/AUD gains some upside momentum but still bearish

FxWirePro: EUR/AUD gains some upside momentum but still bearish  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: USD/JPY gains some ground but bearish outlook persists

FxWirePro: USD/JPY gains some ground but bearish outlook persists  CAD/JPY Bounces to 113.22 — BOC Hold Sparks Dip-Buy Setup Toward 115

CAD/JPY Bounces to 113.22 — BOC Hold Sparks Dip-Buy Setup Toward 115  AUDJPY Powers Up: Bullish Bias Holds Above 107 – Eyes 110 on Breakout

AUDJPY Powers Up: Bullish Bias Holds Above 107 – Eyes 110 on Breakout  Oil Spikes on US-Iran Fire: $66 Highs Hit, Buy the Dip at $57–58 for $63 Bounce

Oil Spikes on US-Iran Fire: $66 Highs Hit, Buy the Dip at $57–58 for $63 Bounce  Fed Pause Fails to Lift Dollar — USD/CHF Pulls Back to 0.76822, Bears in Control

Fed Pause Fails to Lift Dollar — USD/CHF Pulls Back to 0.76822, Bears in Control