French opinion polls and Presidential politics generally are now moving markets in Europe. The bookmakers’ odds of Marine Le Pen winning rose at the start of the week so that the main candidates were level-pegging close to 33%, which triggered selling for the Euro and for French bonds.

In the remote scenario of a Le Pen Presidency with supportive government and Parliament, 10Y Bunds could approach 0bp and 10Y France-Germany 200bp, with sharply wider Bund swap spreads (54bp), FRA/OIS (20bp) and EURUSD cross currency basis (-60bp), and higher volatility (Bund implied 6bp/day).

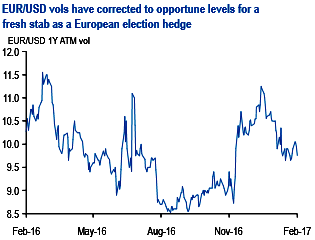

EURUSD vols do not reflect this increased anxiety, however, having dipped 1.5 -2.0 vols across the curve from their December highs (refer above chart).

Even though the probability of a catastrophic electoral outcome in France is low in our mind, the fact that EURUSD carries little-to-no risk premium for a Le Penn shock - short-term fair value models indicate that the currency trades about three cents stronger than Euro-US rate differentials and sovereign spreads would justify – is disconcerting; nor is positioning extreme short enough to suggest sufficient investor preparedness for a tail result.

We prefer outright widener in FRA/OIS as valuations appear cheap by historical standard and we see limited risk of inversion of FRA/OIS (FRA/OIS on 3s curve trading persistently negative). However, given the negative carry of outright widener, we currently hold FRA/OIS steepener between reds and greens. As we get closer to the French election we would be bias to roll the existing position into outright widener: we prefer the front end of the curve (like Sep17 of Dec17), where the negative slide is limited.

EURUSD cross currency basis in our view appears the least attractive way to position for funding stress under a Le Pen presidency with support from FN government and parliamentary majority. Current valuations in reds EURUSD cross currency basis are broadly in the middle of their range since QE started.

In vol, call skew in Bund options is currently not pricing the jump in implieds in a rally in Bund yields (discussed above). That is, OTM calls are cheaper compared to ATM calls indicating that market is still pricing a decline in implieds with yields. Therefore, as a hedge towards the tail risk, we would prefer buying Bund gamma via outright OTM call options.

For example, we recommend buying the 163 Apr Bund gamma via delta-hedged calls (implied vol around 3.8bp/day). The 163 strike corresponds to 10Y German benchmark Bund yield at around 15bp. Ideally, we would prefer options struck around 0% yield and with longer expiries (say the June options which expire in May).

However, on liquidity and gamma considerations we prefer the Apr Bund calls but note that we would roll these into May/June options as liquidity builds up in these contracts.

Buying only Apr Bund gamma outright is not advised but also versus selling maturity matched swaption gamma (Bund calls versus swaption receivers, delta-hedged). As swap spread directionality intensifies, Bund gamma would outperform swaption gamma.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand