As long as the SNB does not provide any signals that it considers exiting its expansive monetary policy, the euro will continue to point the way ahead.

We expect the euro to tend to lose ground against the Swiss franc in the coming months, as the weaker economic outlook for the eurozone and thus the ECB's less scope for action has not yet been adequately reflected in the EUR exchange rate. The ECB will not raise interest rates in the first half of next year, but will probably only become active late in 2019.

However, the SNB's continued expansionary monetary policy relative to the ECB should keep EUR-CHF from falling significantly below 1.14-1.15.

Meanwhile, we consider the risk of a stronger euro due to political reasons to be low. The market has already sufficiently priced in the prospect of a more integrated eurozone.

Moreover, there are no signs that Macron's European plans will be implemented quickly. Once it is foreseeable that the ECB will, in fact, raise interest rates for the first time, EURCHF should rise again, probably in the course of 2019 but in the near-term we expect the underlying pair to remain in the tight range although it manages to hit the new highs.

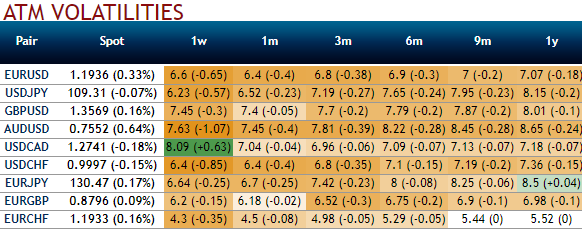

Most importantly, please be noted that the options writers are on upper hand, if you glance at the above nutshell evidencing IVs, EURCHF has been the pair to show the least IVs, while positively skewed IVs of 1m tenors are well balanced and risk is skewed on either side. So, both OTM puts as well as OTM calls will have equal opportunity for expiring in the money.

Lower IVs to offer advantages for options writing that are exorbitantly priced-in. So, never miss out the opportunity in such instruments.

Hence, we advocate shorting EURCHF 1.1515 - 1.2015 strangles of 1m tenors against shorting EURCHF in the spot, the trade is desirable and suitable contemplating low implied volatilities.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 97 (which is bullish), while hourly CHF spot index was at 57 (bullish) while articulating (at 12:42 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge